Situated on Route 66, Albuquerque, New Mexico is a key city on the iconic roadway’s winding path through the American Southwest. This region’s diverse landscape, including mountainous roadways, desert terrain, and urban areas, influences the types of vehicles that buyers are looking for, shaping a special kind of new-car market.

Albuquerque’s car buyers' varying needs create a complex market that dealers must navigate carefully. This complexity makes online reputation management crucial for new car dealers in the area. Potential customers, faced with many options to meet their specific requirements, often rely heavily on online reviews and ratings to guide their purchasing decisions.

Car dealerships in Albuquerque demonstrate a wide range of commitment to the customer experience. Using our Automotive Reputation Index—which ranks dealers by volume, rating, and response rate—we’ve identified the dealerships with the best online reputations in Albuquerque.

- Larry H. Miller American Toyota Albuquerque leads the pack of all dealers in the region by a substantial margin. With a strong average star rating and great overall review volume, this dealership is setting itself up to lead the way in organic search for this region.

- Chalmers Ford exemplifies the consequences of missed opportunities. It has the highest adjusted star rating among these top-ten dealerships but is in the eighth position due to its low review response rate of 89%. Getting its response rate over the 98% threshold is an easy and straightforward way to improve its overall score here.

- There is little separating the top 3 luxury dealerships in Albuquerque. Quality Buick GMC is in third place due to its lower average star rating, which is noticeably behind those of Lexus of Albuquerque and Sandia BMW. Focusing on bringing in more reviews from happy customers will help Quality Buick GMC close the gap with its top competitors.

- Garcia Cadillac of Albuquerque is a great example of what a low star rating can do to a dealership’s online reputation health score. Even its perfect response rate of 100% isn’t enough to balance out the low low average star rating. Addressing negative experiences and asking every customer for a review will help considerably.

- Coming in last place is Tillery GMC. While this dealer has a high adjusted star rating, its review volume and response rate are lacking. Investing in a more comprehensive review management strategy (asking for reviews paired with review responses) would give this dealer the boost it needs to rise in the ranks.

- The lowest adjusted rating belongs to the 9th-ranked dealership of the top ten non-luxury dealers in Albuquerque. Reliable Chevrolet’s low average rating is the only thing keeping it from being in the top 5. The lesson here is to take advantage of every reviewable opportunity. Take the time to ask and encourage your happy customers to write reviews.

- Melloy Nissan is ranked 5th on this list. However, it has more volume and a better average star rating than the dealership just above it in 4th place. Melloy Nissan’s response rate of 92% is what keeps it from overtaking Larry H. Miller Chrysler Jeep Dodge Ram of Albuquerque. By responding to each and every incoming review, this dealer could easily improve this ranking.

*Note from the editor. The Automotive Reputation Index offers substantial coverage of the nation’s dealerships, but it’s still growing. If your dealership is not yet listed on the Index and you’d like to add it, submit your information and we will add it during a regularly scheduled update, roughly once per month.

Widewail's rankings are based on the Widewail Automotive Reputation Index. Explore the full dataset:

Ranking Methodology

To rank these dealerships fairly, we chose a method that takes into account the fact that dealerships on our list receive a wide range of monthly review volume, in part due to varying levels of opportunity. For example, luxury brands simply can never sell as many cars as non-luxury brands, the price point limiting a luxury dealership's market.

To compare two dealerships with very different review volumes directly wouldn’t be fair. A dealer with two 5-star reviews doesn’t necessarily deserve to be ranked higher than a dealer with 200 reviews and a 4.5-star rating. With few reviews, the former doesn’t offer enough data for us to use to understand its performance. However, we couldn’t just ignore locations with very few reviews, as that would introduce bias into our rankings.

To solve this, we used "adjusted ratings" in our calculation of dealership ranking. In essence, "adjusted rating" is a dealership's star rating that takes into account how its review volume compares to that of other dealerships in that area. We calculated adjusted ratings by using a technique called additive smoothing which we explain below.

Additive Smoothing

The approach we’ve used is a form of what’s called “additive smoothing.” This process allows for an unbiased way to rank two otherwise unequal dealerships. At its core, additive smoothing levels the playing field by artificially increasing the number of reviews each dealership has by adding the same number of reviews of each star rating to every dealership.

Customer Engagement

Additionally, we take into account the percentage of reviews that a dealership has responded to in our calculation of ranking, as Widewail strongly believes that review response is indicative of a strong reputation strategy.

Activity

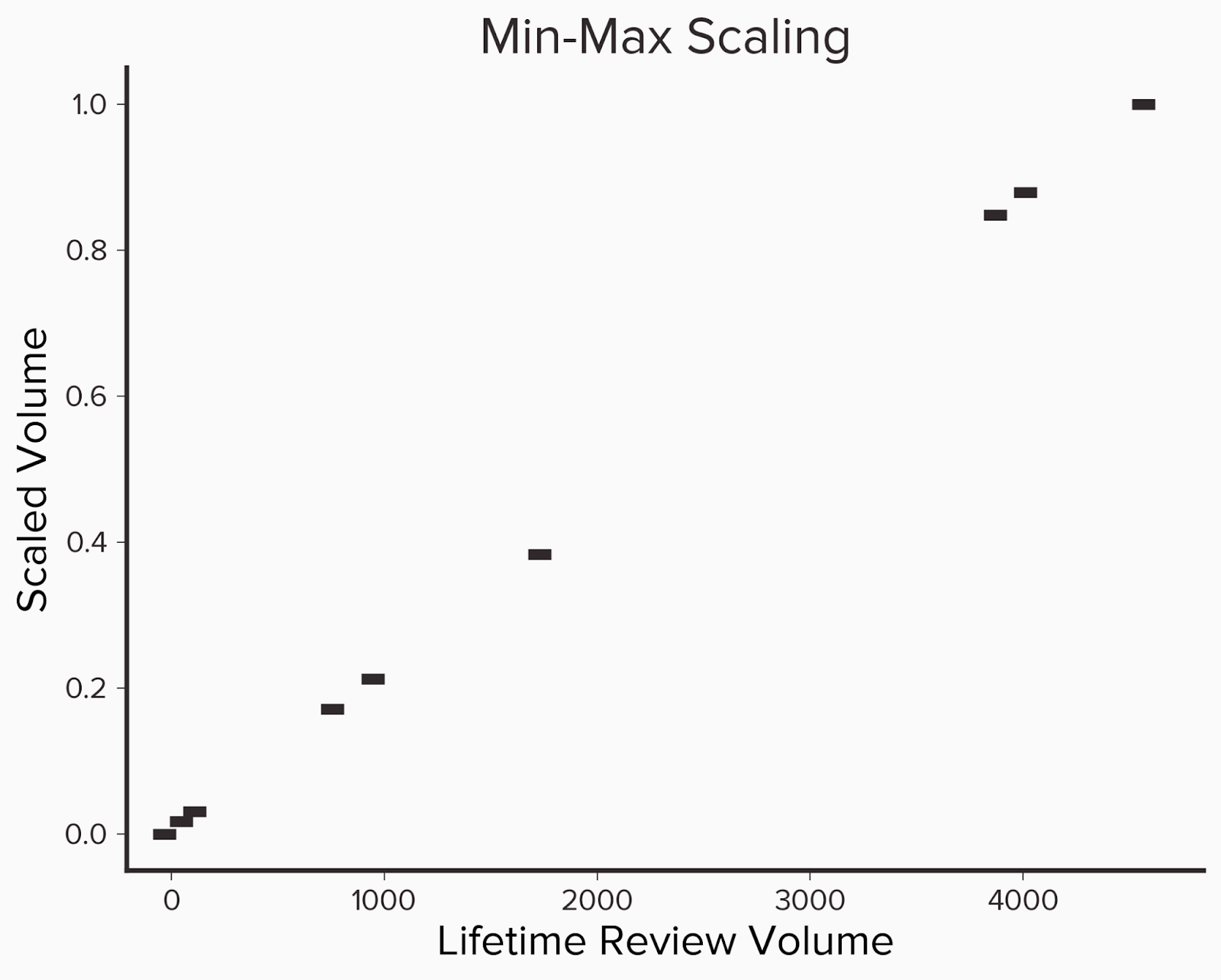

The last component revolves around how much review volume a dealership receives, which can be broken down into two parts - their lifetime volume and average monthly volume. Lifetime volume can be thought of as a popularity metric. It’s an important metric and one of the first numbers that a potential customer will see when they start looking at reviews. The second, average monthly review volume, is representative of how active the dealership currently is. We can think of it as follows, lifetime volume captures a historical view of the dealership whereas average volume gives insight into the current status. The final component for the volume metrics is to scale them so there is a more meaningful comparison. To do this we use what is known as min-max scaling. First, we group dealerships by their respective city and then find the dealership with the most volume and least volume. Then for each dealer in the group, we subtract the lowest volume and divide by the difference between the highest and lowest volume. The formula for this can be seen below.

x' = x - min(x)max(x) - min(x)

The main advantages of this approach are that all the volume metrics can be mapped to a value between 0 and 1 and the relative difference between dealership volumes can still be preserved.

Below we see an example of this where we have 9 dealerships with differing lifetime volumes, which we then scale. Notice that the relative distance between the actual volumes and the scaled versions is the same.

Below we have an example of ten dealerships, their review volume, and the adjusted relative volume. We can calculate the relative volume by sorting the dealers by review volume and determining the percentage of dealers that have fewer reviews. Here we see that dealer D had the most reviews and so they get a score of 1.

|

Lifetime Volume

|

Scaled Volume

|

|

4619

|

1

|

|

4065

|

0.88

|

|

3922

|

0.85

|

|

1783

|

0.38

|

|

1001

|

0.21

|

|

810

|

0.17

|

|

164

|

0.03

|

|

101

|

0.02

|

|

22

|

0

|

The Ranking Formula

(adjusted rating / 5) * 0.3 + (response rate) * 0.3 + (lifetime volume) * 0.15 + (avg monthly volume) * 0.25

Weighting Rational

We chose to weigh each feature as follows: adjusted rating accounts for 30% of the overall score, response rate also accounts for 30%, and review volume is 40%, which is further broken down into lifetime volume (15%) and average monthly volume (25%).

Weight selection is based on Widewail’s depth of expertise in the industry and we believe is a fair representation of what should be considered a standout reputation.

We’ve broken the weighs into three categories:

Activity (40%)

We believe the amount of review activity is the most important indicator of reputation health for a business, and is a leading driver of local search rankings. We’ve broken this category into two components: lifetime volume (15%) and frequency (25%). Lifetime volume is our “popularity” metric.

Engagement (30%)

Engaging with customers by responding to reviews is a key component of a healthy reputation.

Quality (30%)

The rating has a substantial impact on if a business shows up in local search and if that business is entered into a prospect’s consideration set. Rating is a key identifier of business health.

Calculation Details

If a company has an adjusted rating of 4.2, responds to 10% of their reviews and has an adjusted lifetime volume of 0.90 in their city and 0.87 for their scaled average monthly review volume, then we would calculate their overall rating as follows

(4.2 / 5) * 0.3 + (0.1)*0.3 + (0.9)*0.15 + (0.87)*0.25 = 0.252 + 0.03 + 0.135 + 0.2175 = 0.6345 * 100 = 63.45

Note: Since response rate accounts for 30% of the overall ranking, if a dealer doesn’t respond to any reviews that automatically caps the max value they can receive to 70.