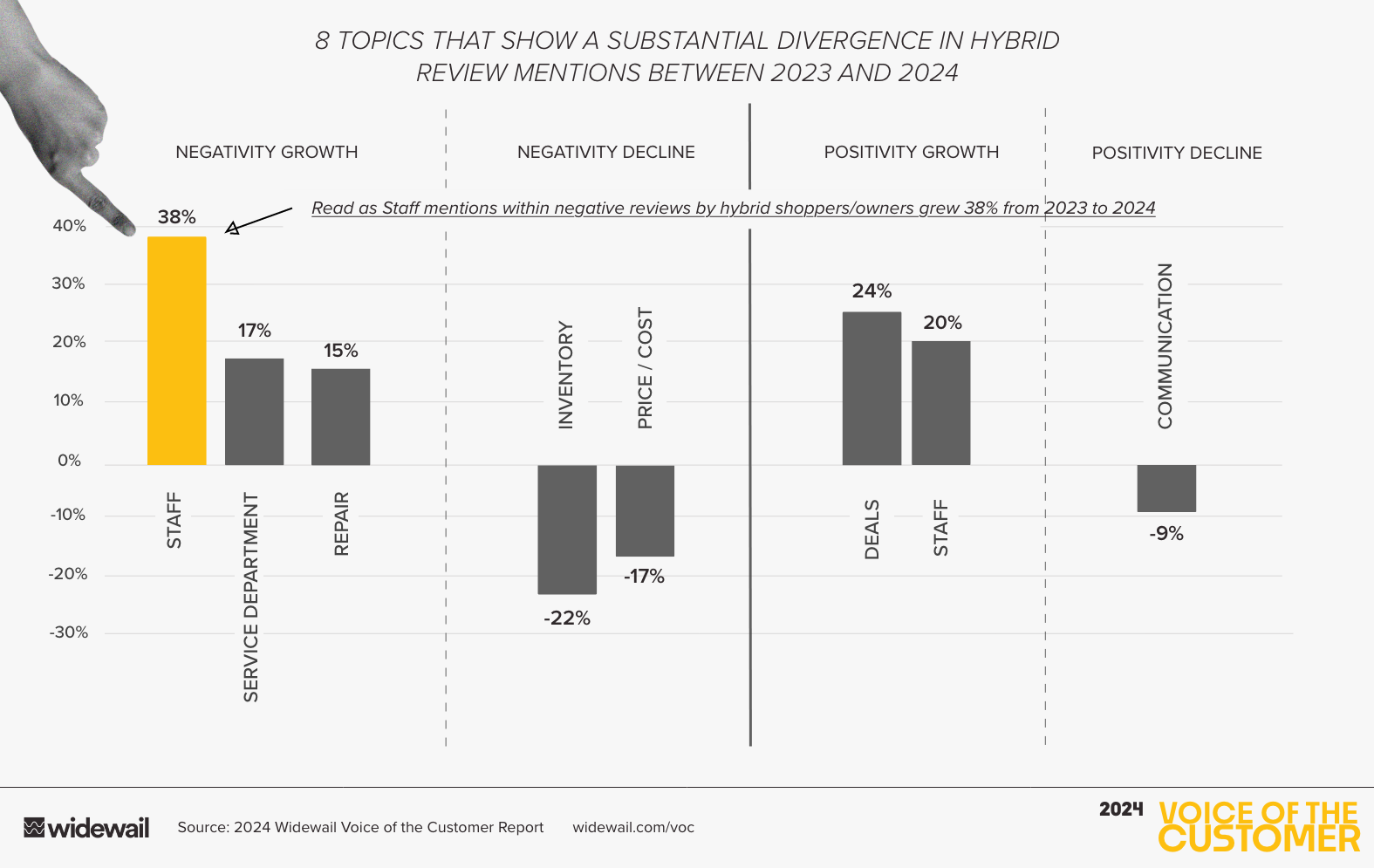

Inventory negativity less. For positives, deals and staff outperform 2023.

When filtering our database for reviews specific to hybrid models, we observe notable topic developments from 2023 to 2024 grouped into four sections: more negativity, less negativity, more positivity, and less positivity. With this, we can narrow 27 topics to just the eight that show the most variation between 2023 and 2024 experiences.

Insight

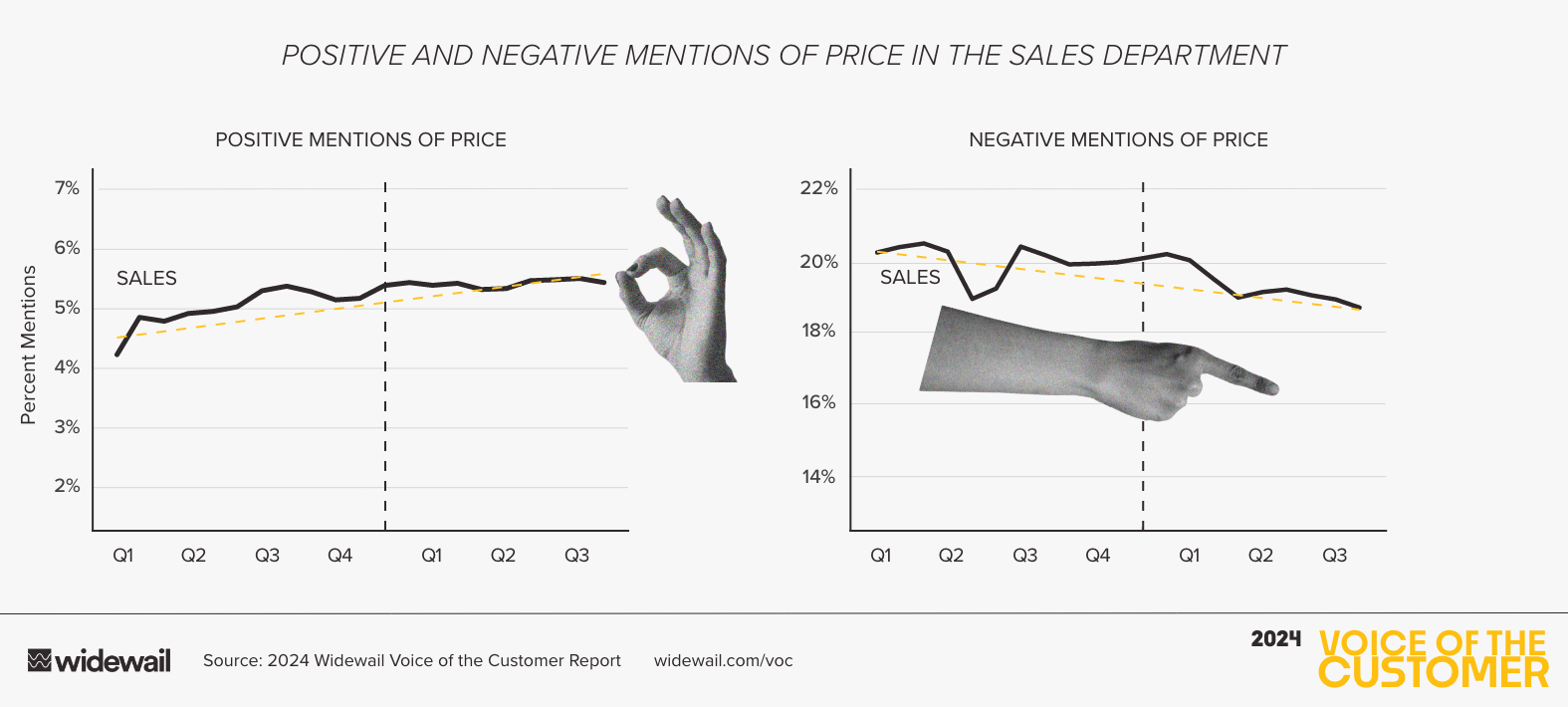

- In Q2 '24, hybrid sales increased to 9.6% of the total market share, a 31% increase over the same quarter in 2023. Hybrids have had a particularly strong year, acting as an intermediate step between ICE and BEV, as buyers are unwilling to adopt full electric at the pace the industry had hoped for a few years ago. From a customer experience perspective, we find that in 2024, there was strong positivity growth in deals offered, paired with declines in pricing and inventory negativity, to paint a picture of a sales experience that improved YoY in lockstep with sales growth.

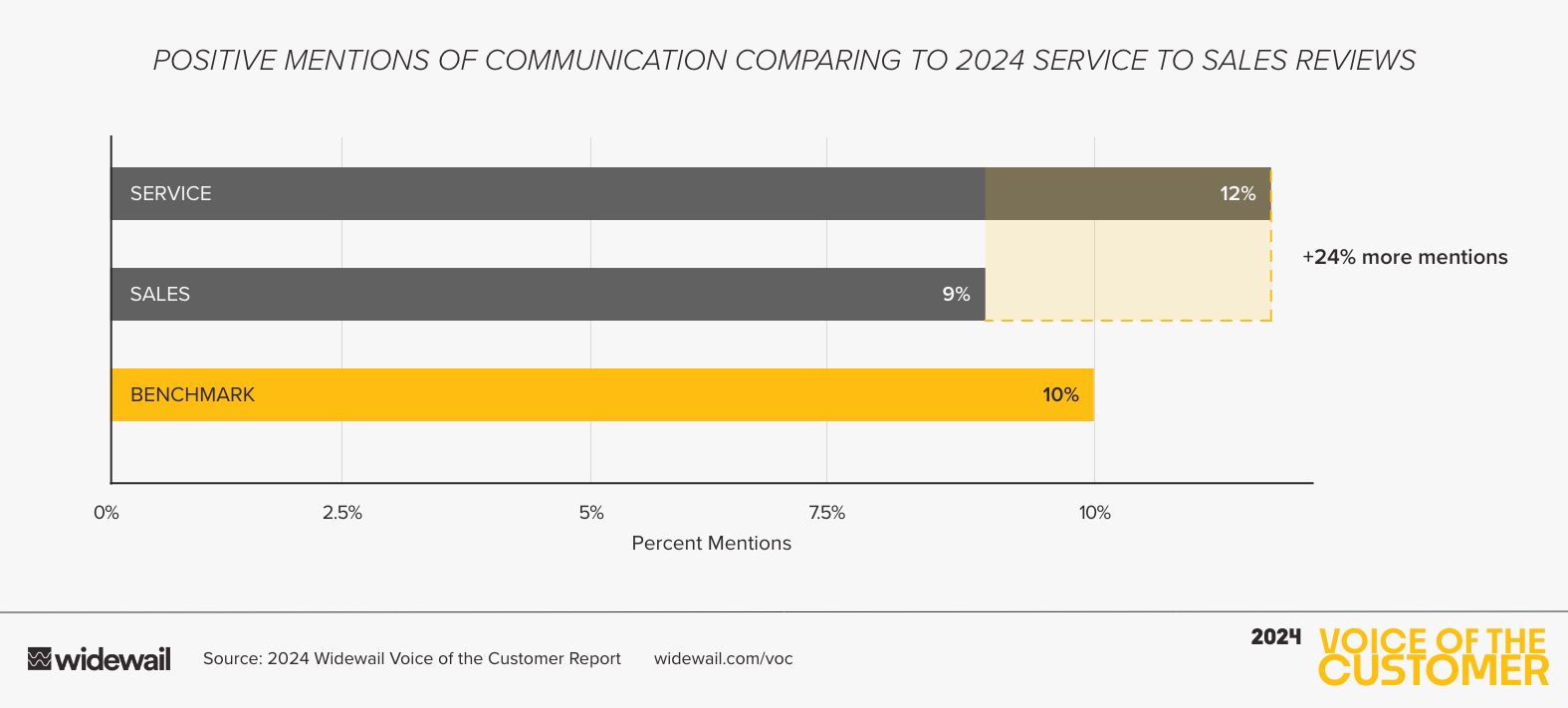

- On the contrary, we find substantial negativity growth for staff, service department, and repair, as well as a 9% positivity decline in communication.