What the Data Says

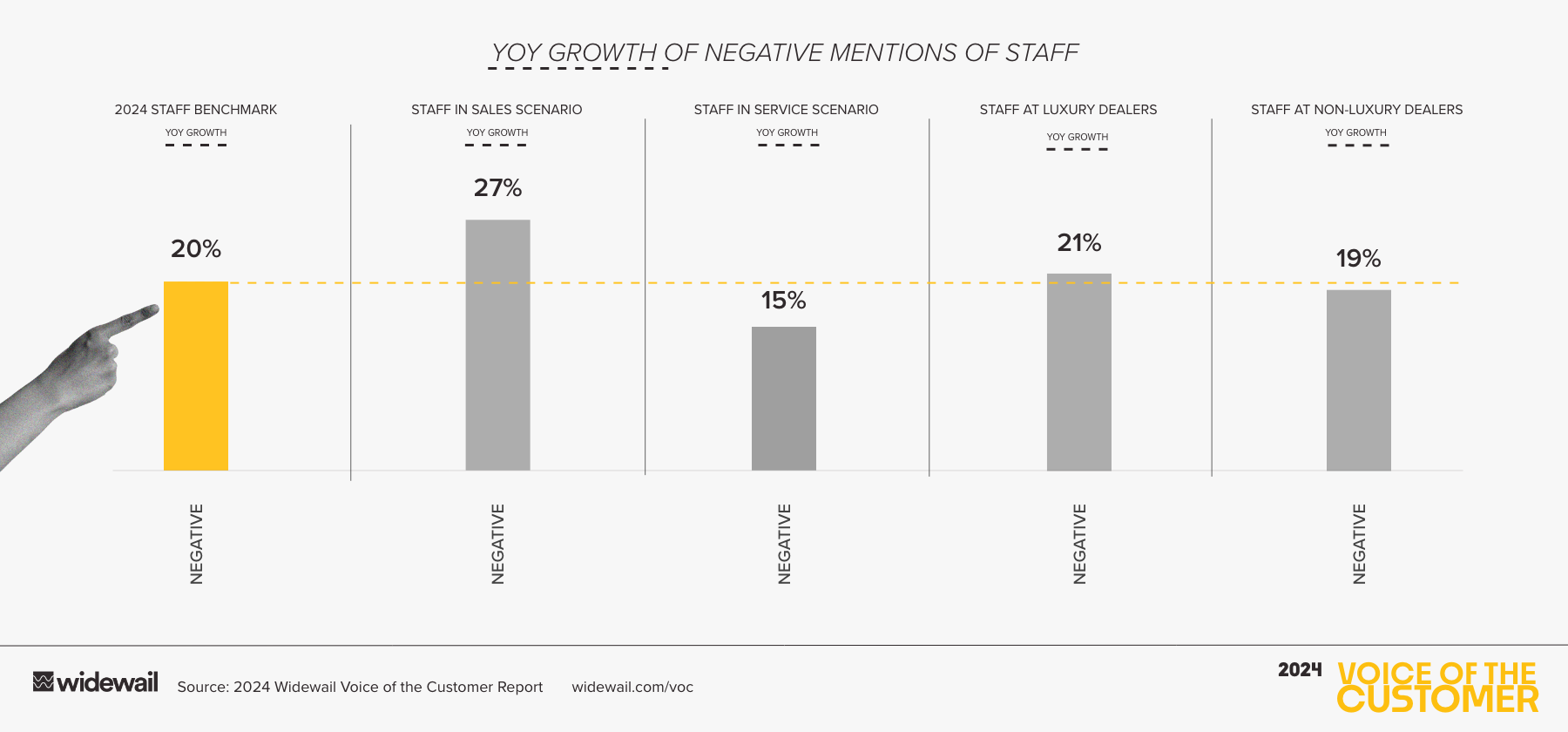

To give key insight #1 more detail that you can take back to the dealership and act on, we researched this scenario further.

How We Researched This

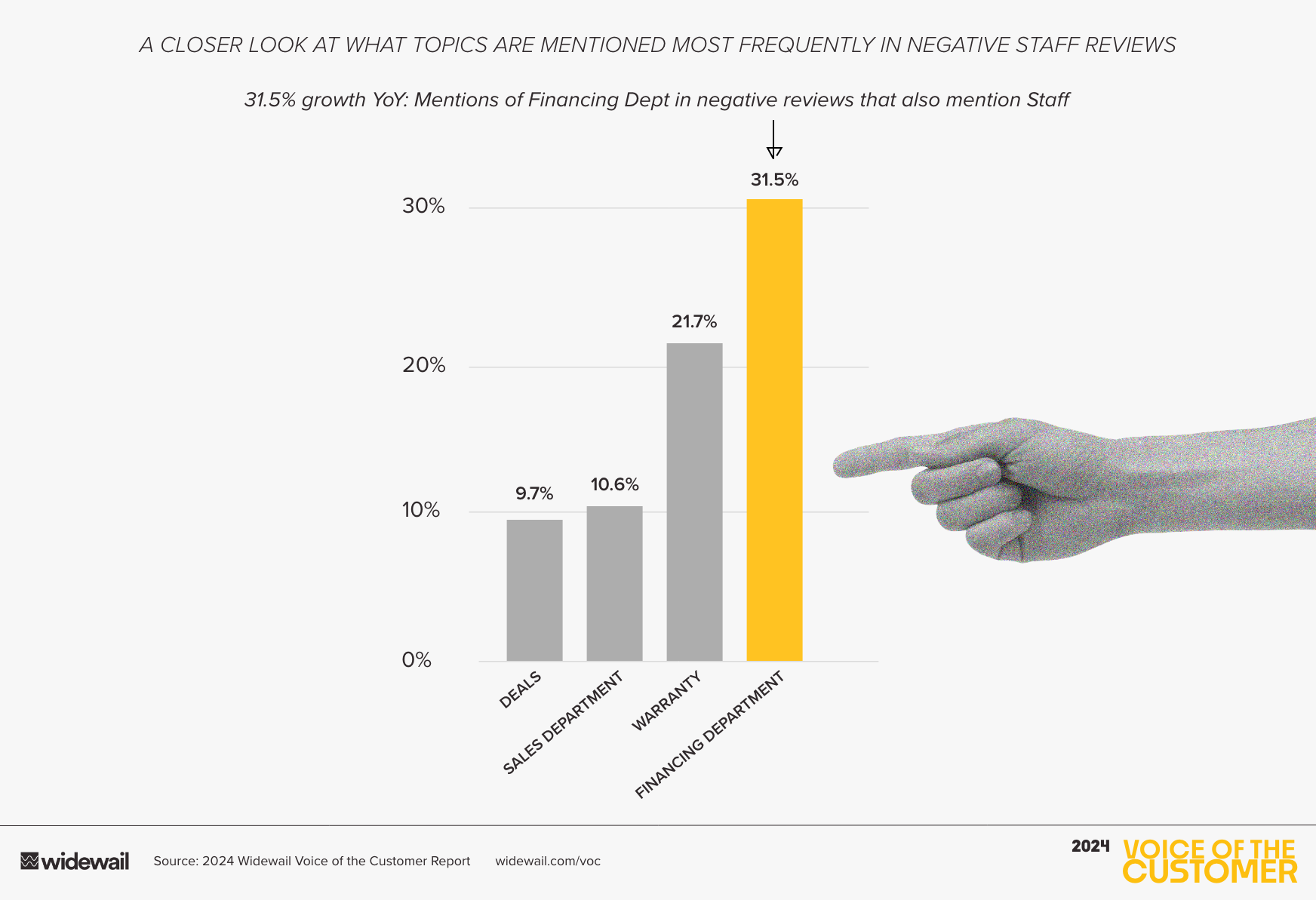

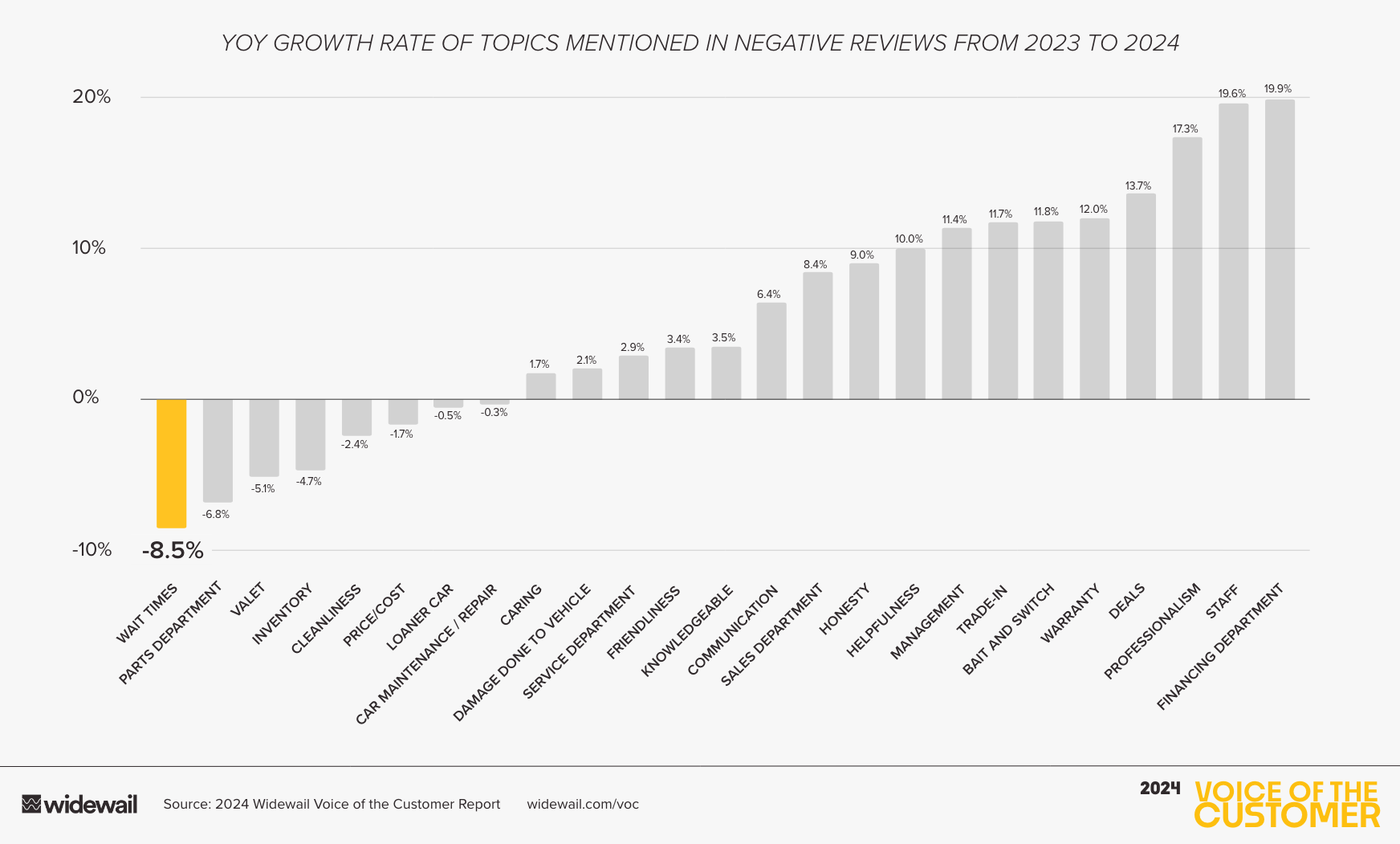

To learn more about staff, we isolated the other topics in the study in the context of staff. First, we filtered by negative reviews (1-3 stars). Then, we isolated all reviews with a staff tag associated with them. It’s important to remember that any review in this study can be, and in most cases is, tagged with multiple topics. Depending on what the customer writes about, reviews can be tagged with anywhere from 1 to 27 topics. Once that filtering process was complete to isolate negative reviews tagged with staff, we looked at the YoY change in topic mentions. We’ve picked out four topics with the highest negativity growth this year, led by the finance department (shown above).

Negative Reviews Mentioning Staff + Finance Department Grow 31.5% YoY

When filtering by negative staff reviews, negative mentions of the financing department grew the most in 2024. This type of review is common and could read something like: “I absolutely love my vehicle. Joe was fantastic in the sales process. When I got into finance, they weren't sure which incentive would apply for this vehicle, they tried to sell me too many F&I products. I don't want GAP. I wish there hadn't been such a high-pressure finish to the sale.”

Recommendations to Dealers

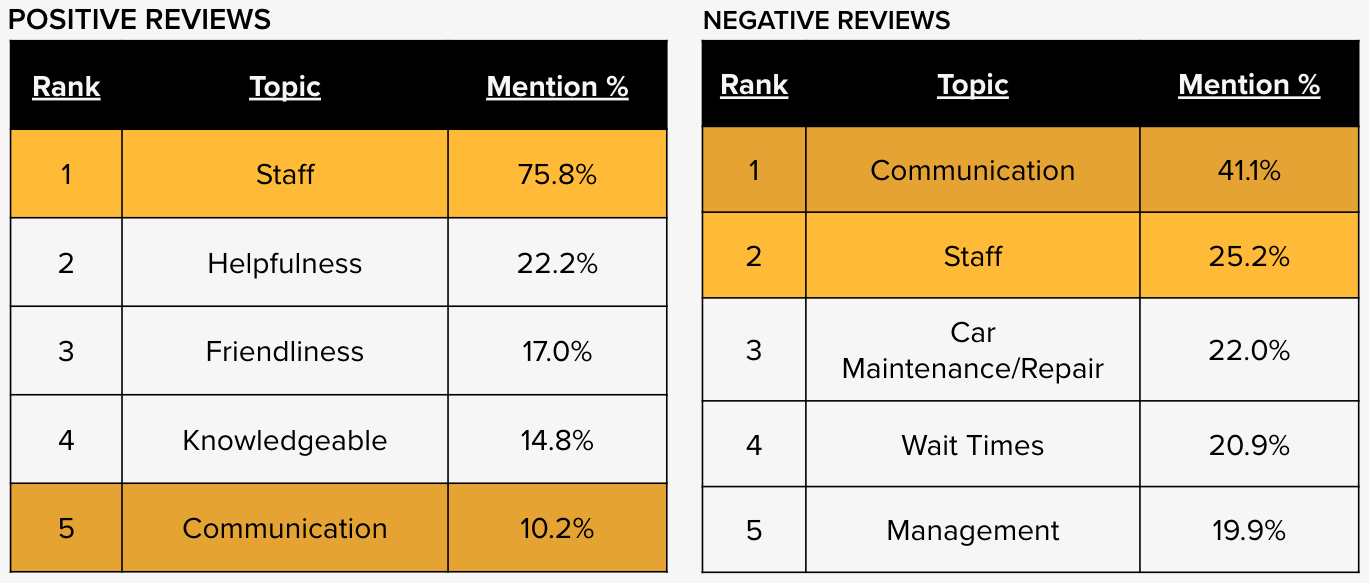

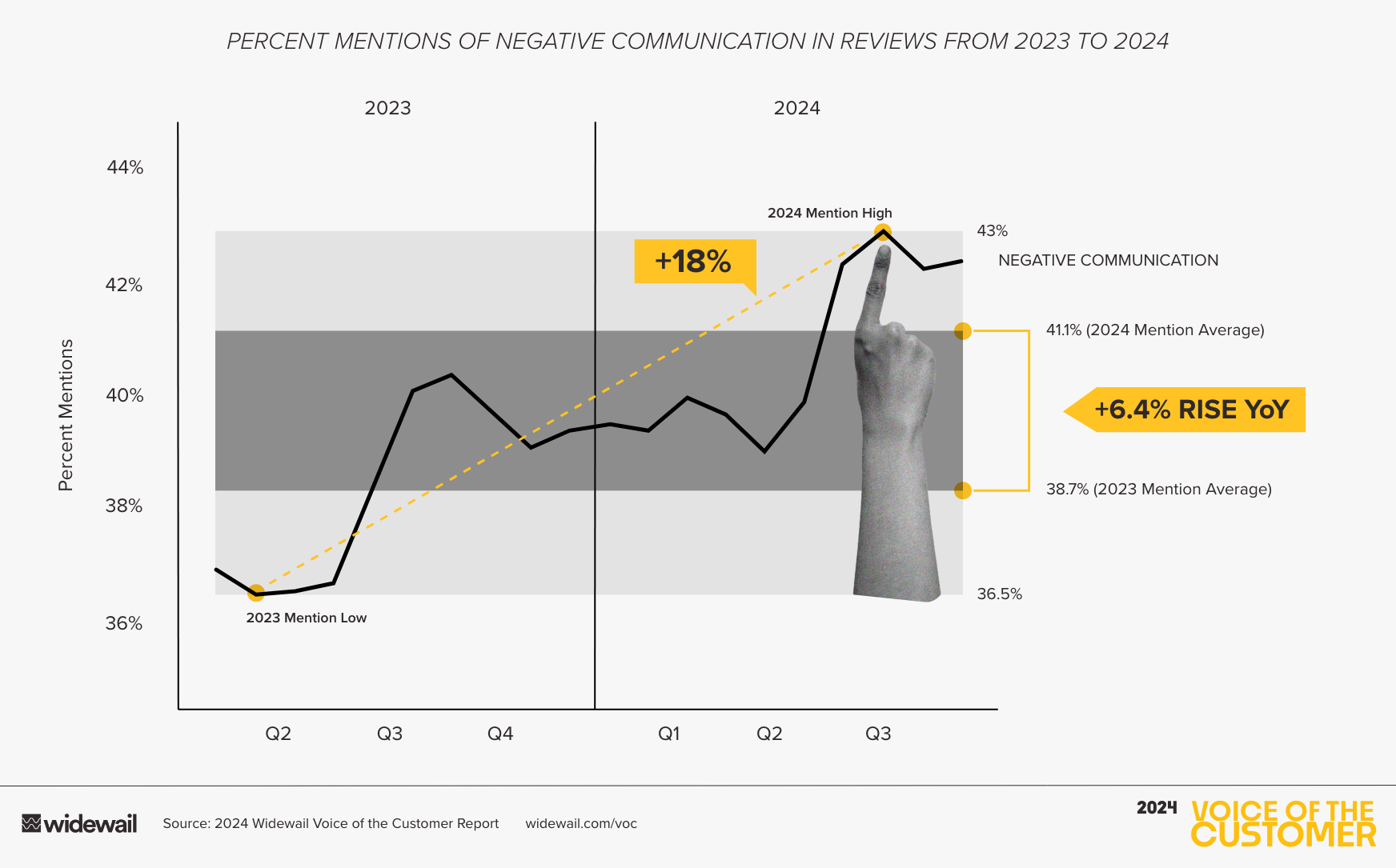

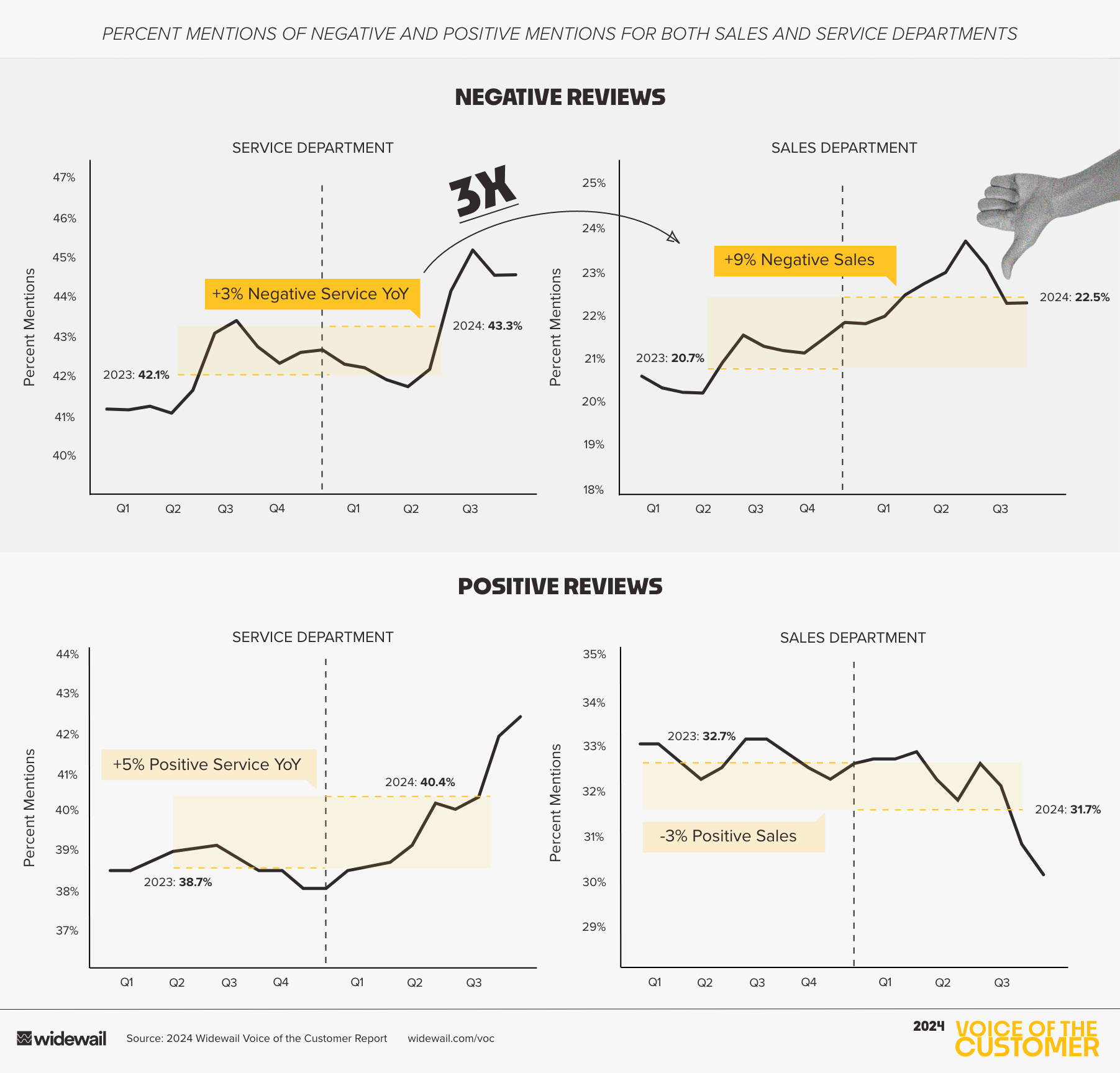

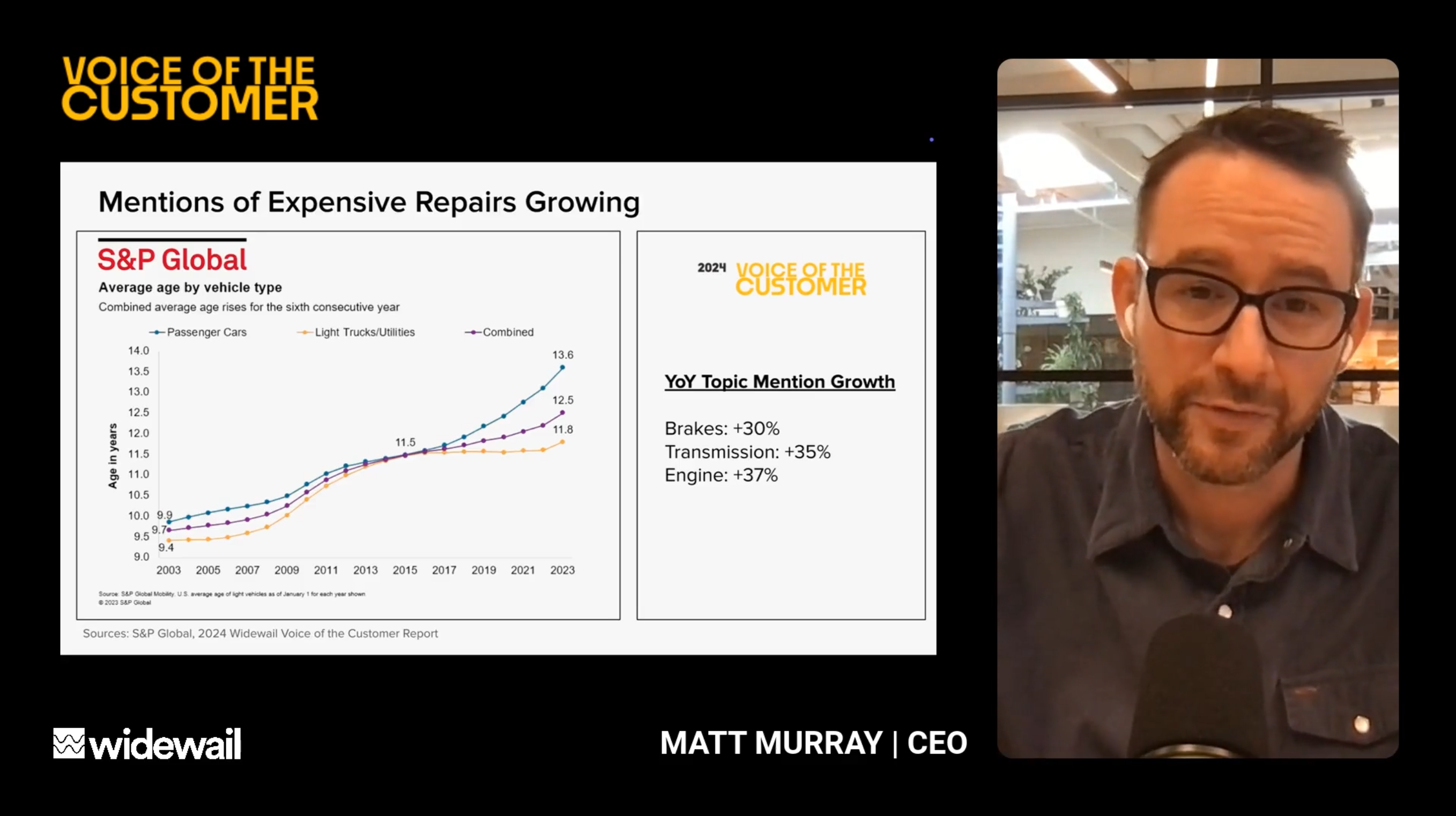

2024 has been a year of increasing complexity. Incentives are back, and with that, there is negotiation. Salespeople are expected to have substantial knowledge of three unique powertrains: internal combustion engines, electric vehicles, and hybrids. Customers are coming in more informed, and they expect their salespeople to be equally knowledgeable. In this environment, transparency and clear communication are critical.

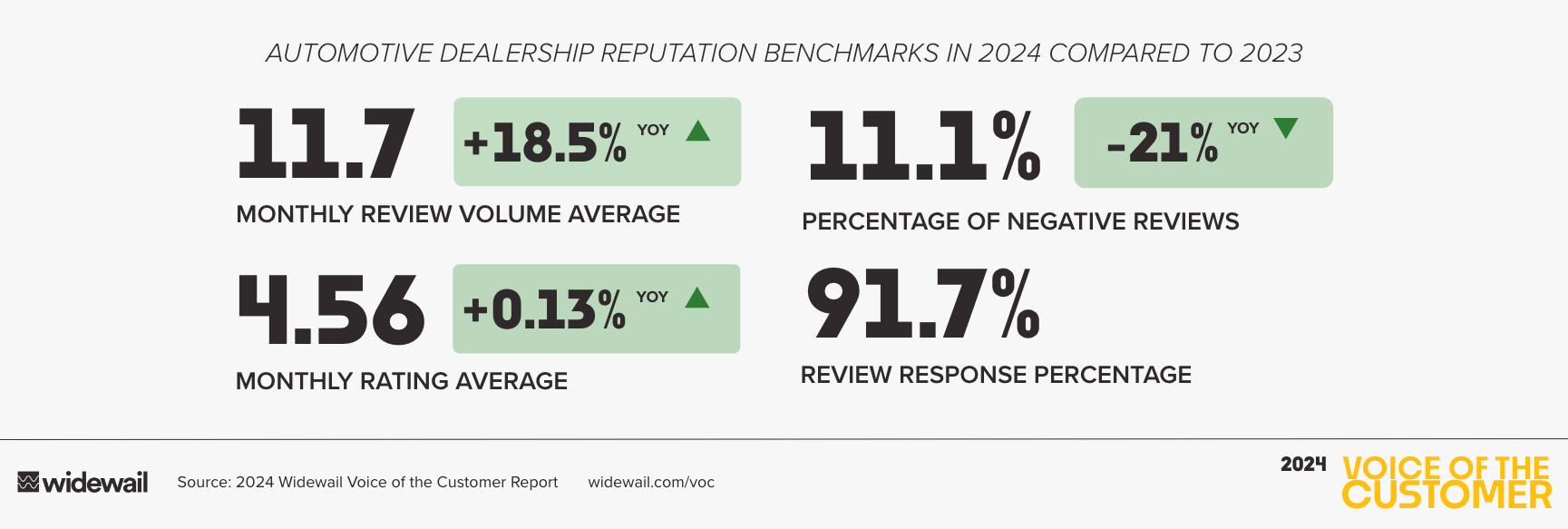

This complexity is beginning to take a toll on customer experience. Don’t get us wrong: 89% of customer reviews were positive last year. 9/10 customer experiences meet or exceed expectations. However, the 10% of negative experiences are still a cause for concern. When customers have a negative experience, it is often due to issues with staff, with large growth in finance staff negativity in 2024.

We recommend that dealers take a proactive approach to improving the customer experience. This means investing in staff development, improving communication, and prioritizing the customer experience at every step of the process.

Where to Focus

The Financing Department

The financing department is a key area of concern for customers. Dealers should work to improve the transparency and efficiency of the financing process.

Address Warranty Concerns

Customers are increasingly concerned about warranties. Dealers should clearly explain warranty coverage and address any customer concerns.

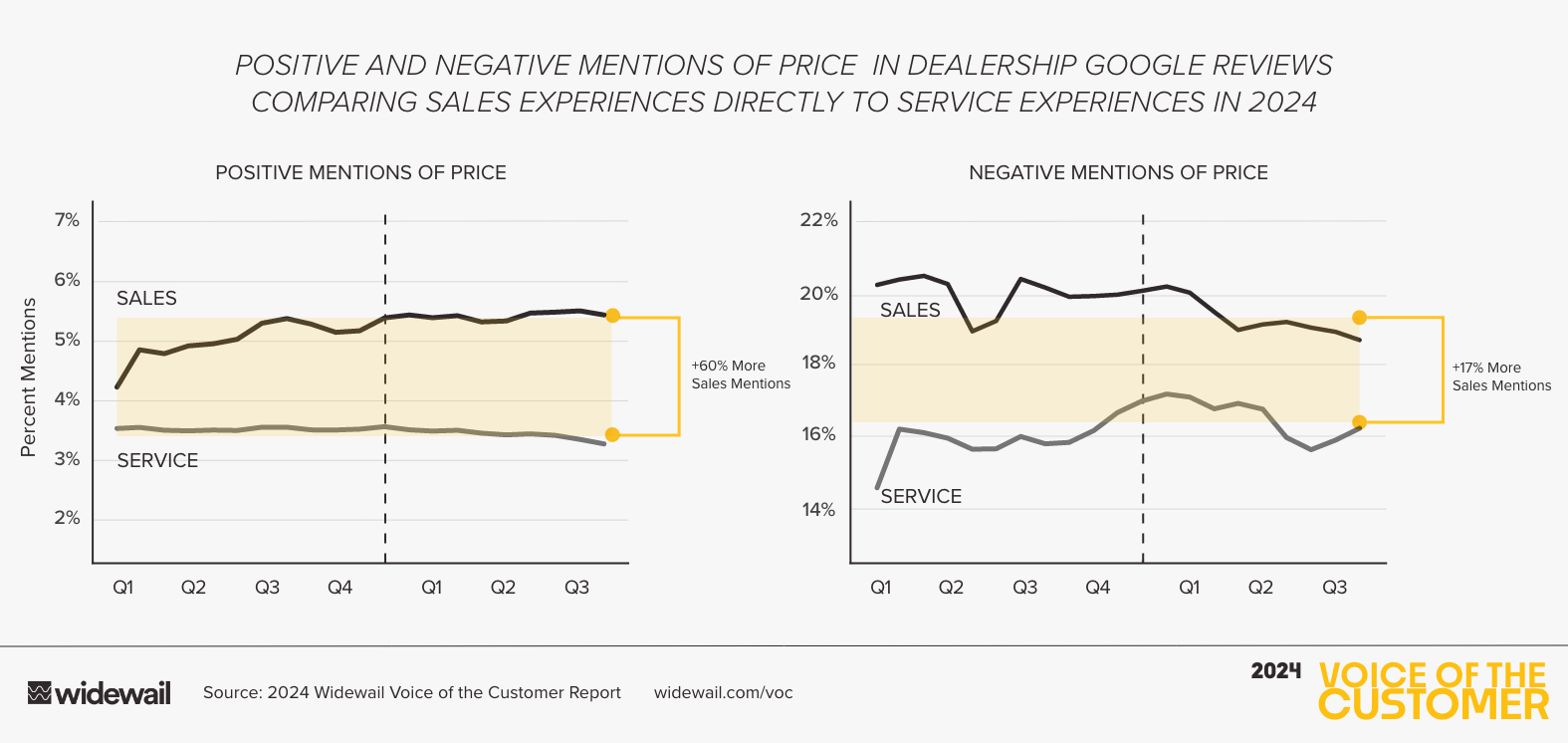

Pay Attention to Deals and Incentives

Customers always seek a good deal. Dealers should make sure they are offering competitive pricing and incentives.

What is talked about in positive reviews that mention staff?

Typically, when customers mention a member of the dealership staff in a Google review, they mention great customer service, particularly being taken care of and being guided through the process step-by-step.

Peeling back the onion, the idea of customers "valuing the clarity provided” is often mentioned in positive reviews.

Clarity of Features and Options

Customers appreciate when sales representatives clearly explain the features, benefits, and options of different car models. This helps customers feel informed and confident in choosing the best vehicle for their needs. Detailed guidance on available trim levels, optional upgrades, and specific technologies (such as safety features, infotainment, or fuel-efficiency) enhances their understanding and makes the decision-making process smoother.

Transparency in Financing and Costs

Positive reviews often highlight when sales representatives provide transparent breakdowns of financing options, total costs, monthly payments, and any additional fees. Clear, upfront explanations about the financial aspects prevent unexpected costs and help customers make financially sound decisions.

Minimal Jargon

Customers value easy-to-understand language. Clear communication simplifies the sales process and makes it feel less intimidating, which can be especially reassuring for first-time buyers or those unfamiliar with the nuances of the process or the vehicles themselves.

Consistency and Honesty

When information is consistently clear from the start to the final paperwork, it builds trust. Customers feel reassured when the details they hear in initial conversations match the information presented at signing, reinforcing the dealership’s reliability and integrity.

Setting Realistic Expectations

Positive reviews frequently mention when representatives set clear, realistic expectations about delivery times, maintenance schedules, or follow-up services. When customers are well-informed and prepared for the next steps, they feel more comfortable and satisfied with their purchase.