Uncover how EV brands stack up in the automotive industry with these unique insights from customer review data.

The buzz around electric vehicles (EVs) is palpable. With reports touting the growing popularity of EVs and owners expressing high satisfaction with their purchases, the shift toward sustainability is taking shape in the automotive industry.

Despite this, delving into online review data suggests that EVs receive lower ratings than traditional gas-powered vehicles.

How could this be?

We turned to the online review data found in Widewail’s 2023 Voice of the Customer Report (VOC) to explore the evolving preferences of car buyers, understand EV customer sentiments and measure how they compare to the rest of the auto industry.

In our analysis, we look at the reviews from three distinct groups:

We found that both EV groups rank below the auto industry average rating benchmark of 4.41 stars. Dealership-sold EV reviews trend slightly below the industry average with a rating of 4.30 stars. DTC brand Tesla’s reviews ranked the lowest of them all: its reviews average at 3.89 stars.

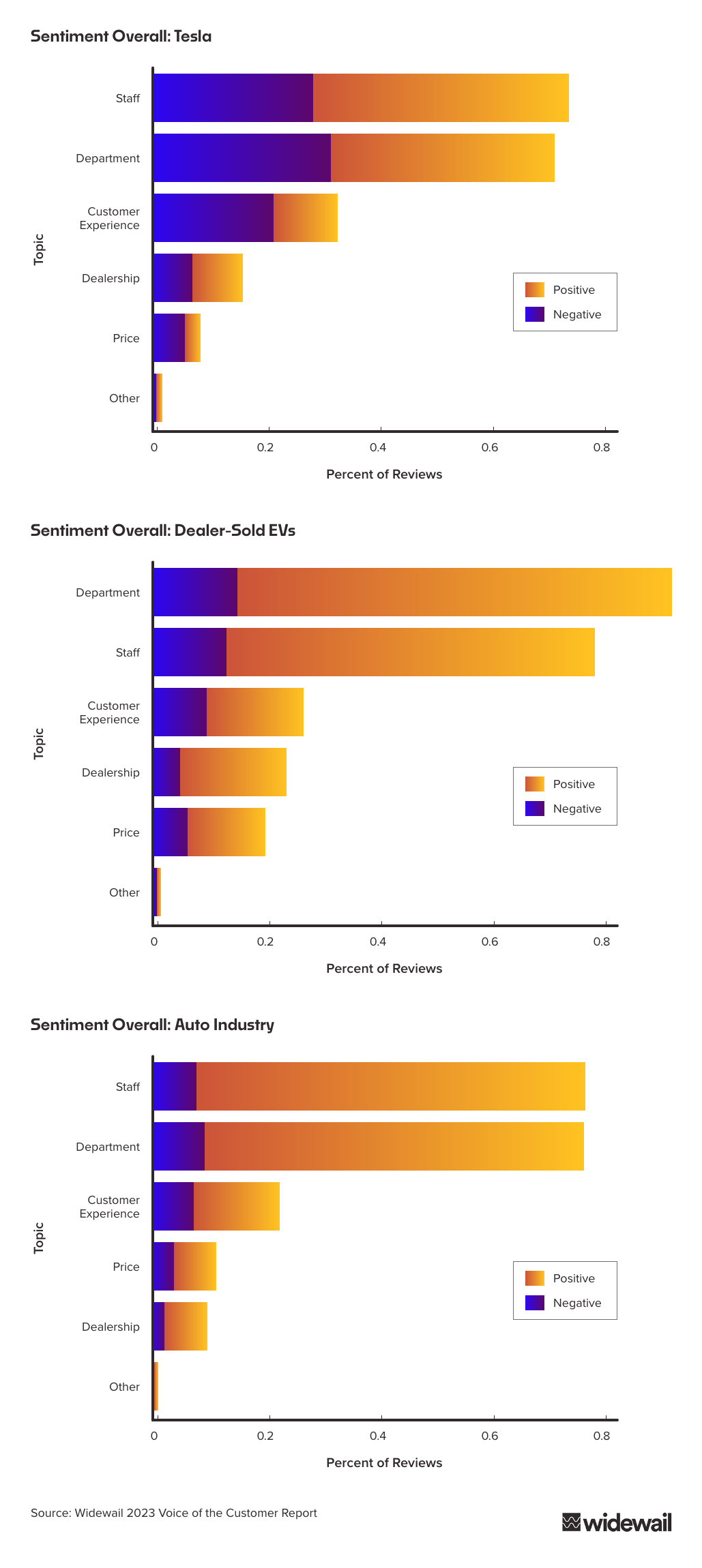

To understand these lower-than-average ratings, we performed a topic and sentiment analysis of all EV reviews. The following charts break down the distribution of topics mentioned across reviews and their impact on positive or negative sentiment.

As Tesla had the most negative sentiment, we chose to look at the DTC brand specifically in comparison to dealership-sold EVs and the auto industry as a whole.

We found that, compared with dealer-sold EV and auto industry stores, reviewers are more unhappy with the customer experience at Tesla.

Customer experience is not typically a category where car dealers fall short. As seen in the overviews for dealer-sold EVs and the auto industry, reviews mentioning customer experience are largely positive.

However, more than half of Tesla’s reviews that mention customer experience are negative. We have attributed Tesla’s increased negative sentiment to three factors:

Widewail’s research has proven that there is a positive correlation between review volume and average star rating. Meaning dealerships with higher review volume tend to have a higher star rating. For Tesla locations, lower review volume translates to a lower average star rating.

When a customer purchases a Tesla, they often work directly with the brand online rather than at a physical dealership or store. As a result, Tesla customers have fewer interactions with Tesla staff. Across the automotive industry, staff is the #1 driver of reviews, therefore it’s less common for satisfied customers to share a positive sales experience on a review site.

Much of the factors behind Tesla’s review sentiment numbers also explain why dealer-sold EV reviews trend below industry benchmarks. However, dealer-sold EV review sentiments differ when it comes to negative sales reviews.

For dealer-sold EV locations specifically, we found that 12% of their negative reviews mention inventory. For perspective, inventory only comes up in 3.6% of DTC EV reviews.

While dealerships are concerned with stocking the correct number of EV vehicles on the lot, DTC EV stores operate differently. On-site inventory is not their focus, and they can concentrate on showing off models without needing to stock vehicles in the same way for interested buyers.

For dealer-sold EV customers, there’s less flexibility when it comes to inventory and a higher expectation that their vehicle of interest will be in stock, leading to a greater proportion of negative sales reviews than service.

While each group faces unique industry challenges, we found that overall, the issues experienced by EV and auto industry customers are similar. Both groups struggle with poor staff communication and negative experiences with the service department.

Review volume and industry-specific expectations help explain the disparity in negative reviews for EVs vs. gas vehicles, but what do the positive reviews say?

The landscape of automotive customer reviews reflects consumer preferences and expectations that are constantly evolving. While the overall sentiment for gas-powered vehicles averages slightly higher than that for EVs, the narrative isn't a straightforward win for gas vehicles.

The EV industry has made remarkable strides, trailing slightly behind gas vehicles in review sentiment but demonstrating significant progress in a relatively short span.

While there's undeniable work ahead for EV brands to improve the customer experience and generate more reviews, there is still a general sense of satisfaction among EV customers and the potential to improve ratings even further.

To uncover even more insights and statistics about customer sentiment in the automotive industry, download the free 2023 Voice of the Customer Report.

Originally from Scarborough, Maine, I moved to Vermont after graduating from St. Lawrence University, where I received my BA in English and Spanish. I have always been interested in writing and communication, which is what initially drew me to the Review Response Specialist position at Widewail. In my spare time, I can be found reading, playing electric guitar, or strolling/biking around one of Burlington’s many scenic trails. I always welcome the opportunity to talk about my work, and invite anyone with questions or comments to reach out or connect with me on LinkedIn.

Bite-sized, to-the-point, trend-driven local marketing stories and tactics.

U3GM Blog Post Comments