-

Products

TechnologyManaged Services

- Resources

- Pricing

- Company

Discover the driving forces behind automotive customer reviews and survey software with these 5 stats from Widewail’s 2023 Voice of the Customer Report.

*This post was updated on November 8th and originally published on January 31, 2024.

Customer reviews reveal trends and sentiments that shape the landscape of the automotive industry. And top customer feedback points can vary and show patterns from city to city.

In Widewail’s 2023 Voice of the Customer (VOC) Report, we analyzed 1.5 million Google reviews from 16,000+ new car dealerships in the U.S. from February to June of 2023. After our data science team analyzed the topics and sentiment of these reviews, five statistics stood out.

We’ll discuss these stats and how they reflect the customer sentiments that impact review rankings throughout the automotive industry. But before we get started...

Where competition is fierce and customer expectations are constantly evolving (Automotive), utilizing the right tools can make all the difference. One such potential insight gatherer, which remains surprisingly underutilized, is automotive customer survey software.

There is immense value to rooftops and auto groups via gathering feedback directly from their customers. Survey software not only simplifies the collection process but also transforms raw data into actionable insights, enabling the identification of pain points, service quality improvement opportunities, and the refinement of their overall customer experience efforts.

You can see how the survey-solution differs greatly from mining your Google Business Profile reviews for sentiment-related info. Right?

What makes automotive customer surveys so powerful is the ability granted to provide real-time insights at every critical touchpoint in the sales or service process. Whether it's a pre-sales inquiry, post-service visit, or vehicle delivery experience, these surveys help dealerships clue in on exactly what their customers think. And then act accordingly.

For example, a dealership could discover that customers are dissatisfied with service wait times, or that buyers are looking for more electric vehicle inventory options. Armed with this knowledge, informed decisions that directly address customer needs are... everywhere.

Online customer reviews alone can't measure shopper sentiment with a dealership survey's level of efficiency and depth. Not even close.

By integrating survey results, especially integrated into CRM systems and/or analytics dashboards, rooftops and groups alike can take their feedback strategy to the next level. The data collected doesn’t just sit idle - it becomes a revenue driver. Dealerships can use it to improve CSI (Customer Satisfaction Index) scores, strengthen relationships with manufacturers, and even enhance their online reputation by encouraging satisfied customers to leave positive reviews.

Not to mention the benefits to customer loyalty and repeat business. In the uber-competitive arena of car sales and service, where every competitive advantage counts, automotive customer survey software is truly a best-kept secret that has the potential to transform how dealerships operate and engage with their customers.

Now, back to our regularly scheduled post...

As a dealership customer, you’re much more likely to leave a positive review if you make a personal connection with a staff member. Therefore, it’s not surprising to find that positive experiences with staff were the most predictive of a positive review outcome.

Our findings show that staff influence on a review outcome significantly overshadows pricing topics such as cost, warranty, and deals. In fact, mentions of staff are 5x more predictive of a positive outcome than pricing. Even compared to operations-related topics like inventory or service amenities, the staff's role remains paramount at 12x more predictive of positive outcomes.

While it’s easy to see that human connection is a driving force for dealership ratings, we were interested in what exactly sets staff members apart.

We discovered that attributes like helpfulness, friendliness, and professionalism are the most valued, highlighted in 22% of all tagged review topics. Furthermore, over 57% of reviews mention individual team members by name.

Reviews are people-driven. Human interaction is integral to success in the automotive industry. To build a positive reputation for your dealership, you need to be able to rely on your team.

Good customer interactions don't exist in isolation; they rely heavily on effective communication.

Poor communication can keep even the most experienced team from delivering a five-star experience. Whether it's delays in response, lack of clarity, or miscommunication at any touchpoint, bad communication impacts the entire customer experience.

Specifically, communication issues related to wait time are the most common in negative reviews, being mentioned 3.1x more frequently than in positive reviews. Car dealers, especially their service departments, need to be good at setting expectations for wait times and giving prompt updates when timing changes.

Despite the average cost of new vehicles hitting a staggering $48,451 in 2023 (a sharp 61% increase since 2012), pricing is not a major driving factor of sales customer reviews.

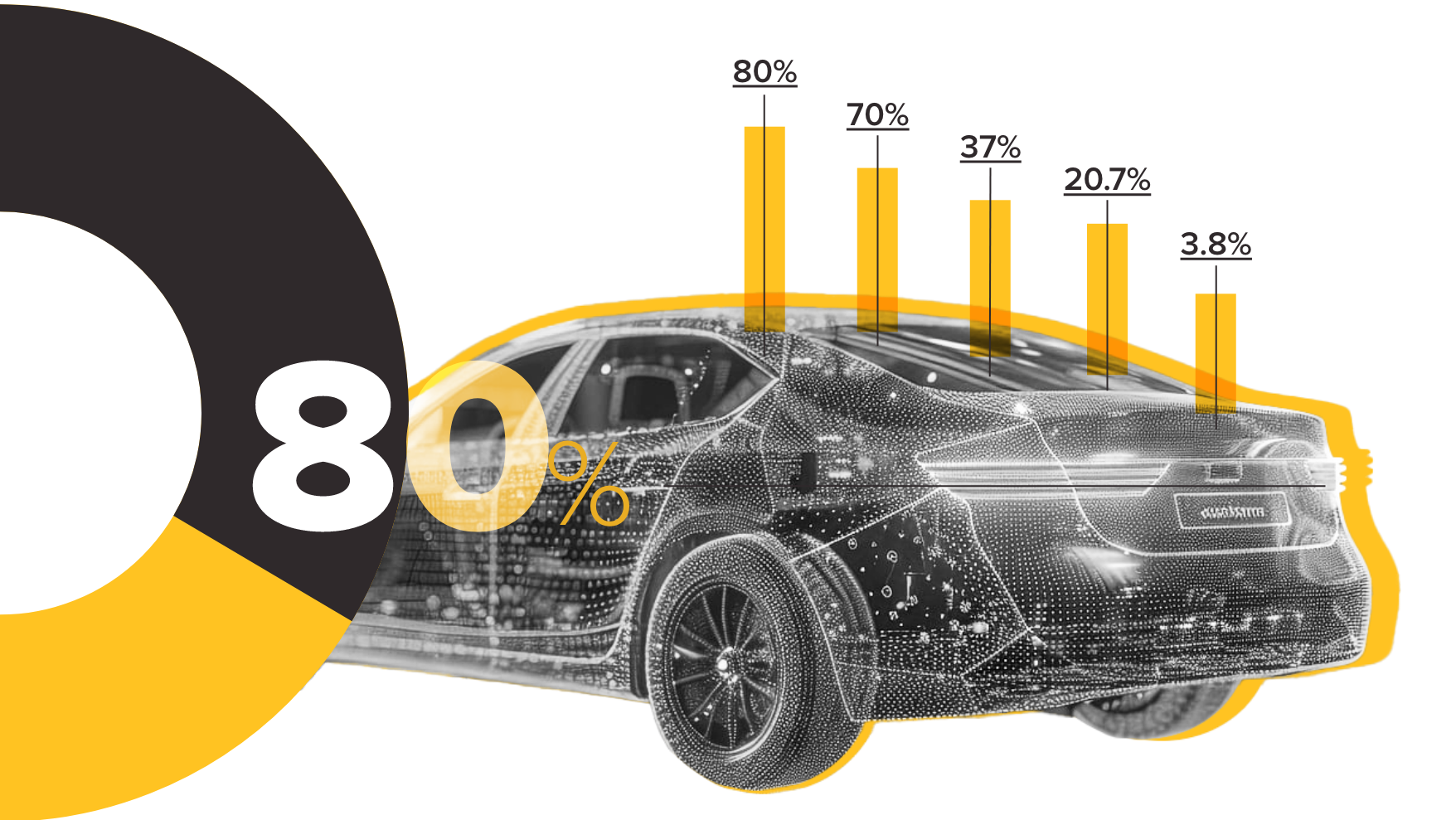

A mere 4.4% of positive reviews mention pricing, suggesting that more of the mentions come from negative reviews. Almost 5x as many negative reviews comment on price than positives - with 20.7% of negatives focused entirely on the topic.

The disparity in how pricing affects review sentiment is linked directly to review content and whether it concerns the Sales or the Service department.

When purchasing a vehicle, people expect to pay a lot of money. Even the most basic car commercial will include an asking price, leaving little room for customers to be surprised or angered by cost. The infrequent mention of pricing in positive reviews reflects this and suggests consumers generally know what to expect from automotive pricing.

In negative reviews, however, pricing comes up much more often, especially in a service context. We assume this is because the price of servicing a vehicle can be unpredictable. Service-related expenses vary per situation and often aren’t communicated properly throughout the customer experience, leading to more dissent and upset.

Overall, while seemingly one of the most influential elements of the automotive industry, when it comes to 2023 customer sentiment, pricing did not have as great of an impact as expected.

Deals and promotions help dealerships build their customer base and bring in prospects. However, they don't wield the anticipated sway over review sentiment.

Our stats show that deals, special pricing, and discounts rarely come up in positive and negative reviews. Customers bring up deals in only 3.8% of positive reviews and 2.1% of negatives.

While deals can be a great way to get a customer's attention and initiate a connection, they don't singularly shape the narrative of a review or define the overall customer experience.

Even with electric vehicles (EVs) gaining momentum in 2023, we found that the average rating of reviews mentioning EVs falls slightly below the industry benchmark, averaging a 4.30-star rating compared to the automotive industry’s 4.41-star average.

Even lower than EVs in general was the direct-to-consumer EV brand, Tesla, whose locations had an average star rating of 3.89.

However, this is not to say that sentiment among EV customers is low. While reviews mentioning EVs trend slightly below the industry average, generally, EV customers are happy.

Nonetheless, the slightly lower average rating for EV mentions is directly attributed to a lower review volume for EV stores overall.

The scatter plot below demonstrates that review volume correlates positively with the average star rating, meaning that the more reviews a dealership has, the higher its average star rating will be.

This positive correlation can also help explain why EV stores receive more negative reviews. With fewer EV customers in the market, EV-related review scores have a slight negative bias built in.

To learn more about automotive customer reviews, trends and insights, check out the entire Voice of the Customer Report.

Originally from Scarborough, Maine, I moved to Vermont after graduating from St. Lawrence University, where I received my BA in English and Spanish. I have always been interested in writing and communication, which is what initially drew me to the Review Response Specialist position at Widewail. In my spare time, I can be found reading, playing electric guitar, or strolling/biking around one of Burlington’s many scenic trails. I always welcome the opportunity to talk about my work, and invite anyone with questions or comments to reach out or connect with me on LinkedIn.

Bite-sized, to-the-point, trend-driven local marketing stories and tactics.

Automated Review Generation

Video Testimonial Generation

Maintain Accurate Listings

Private Surveys

Review Response Managed Services

Social Media Engagement Services

©Widewail 2026.

U3GM Blog Post Comments