Industry: Automotive

Published: 1.2.25

Dataset: 8.1M Google Reviews, 18,000 US-Based New Car Dealers

Timeframe: 2023-2024

Using Google Reviews and AI to Rank Customer Experience for the Largest Names in Automotive…

Each year, Widewail’s Brand Reputation Scorecard uses millions of Google reviews to characterize each automaker’s dealership customer experience using insights from its customers' words. Widewail’s AI technology can organize, interpret, distill, and measure millions of free text reviews into clear insights.

Built on data from 8 million Google reviews from 18,000 new car dealerships across the U.S. in 2023-2024, this report uses AI to analyze and uncover trends in customer experience at scale.

Reputation has evolved beyond digital marketing. It is now a critical operational tool for improving decision-making and optimizing the customer journey. On top of this, AI is everywhere—but how are marketing teams using it to truly understand their customers? This report demonstrates how AI can transform dealership performance by turning customer feedback into actionable insights.

Widewail’s AI-powered system categorizes and tags reviews across 27 unique topics, calculating the percentage of reviews that touch on each one. This approach reveals key trends shaping the automotive industry and provides a clearer picture of customer needs.

The report is broken into two sections. One, Widewail’s rankings and analysis of trends found in this year’s brand reputation scorecards, and two, a directory of in-depth scorecards for each OEM and dealer group profiled in this report.

We’ll start with OEM reputation rankings in 2024, followed by an examination of the winner to better understand the brand’s strengths. To round out the analysis section, we identify the brands making strong moves up the rankings in 2024 and those that have faded.

This section is focused on OEM data. All dealer group data can be found in the scorecard directory.

The core of this report is a directory of brand reputation scorecards that provide reputation metrics and topic analysis for each OEM and dealer group.

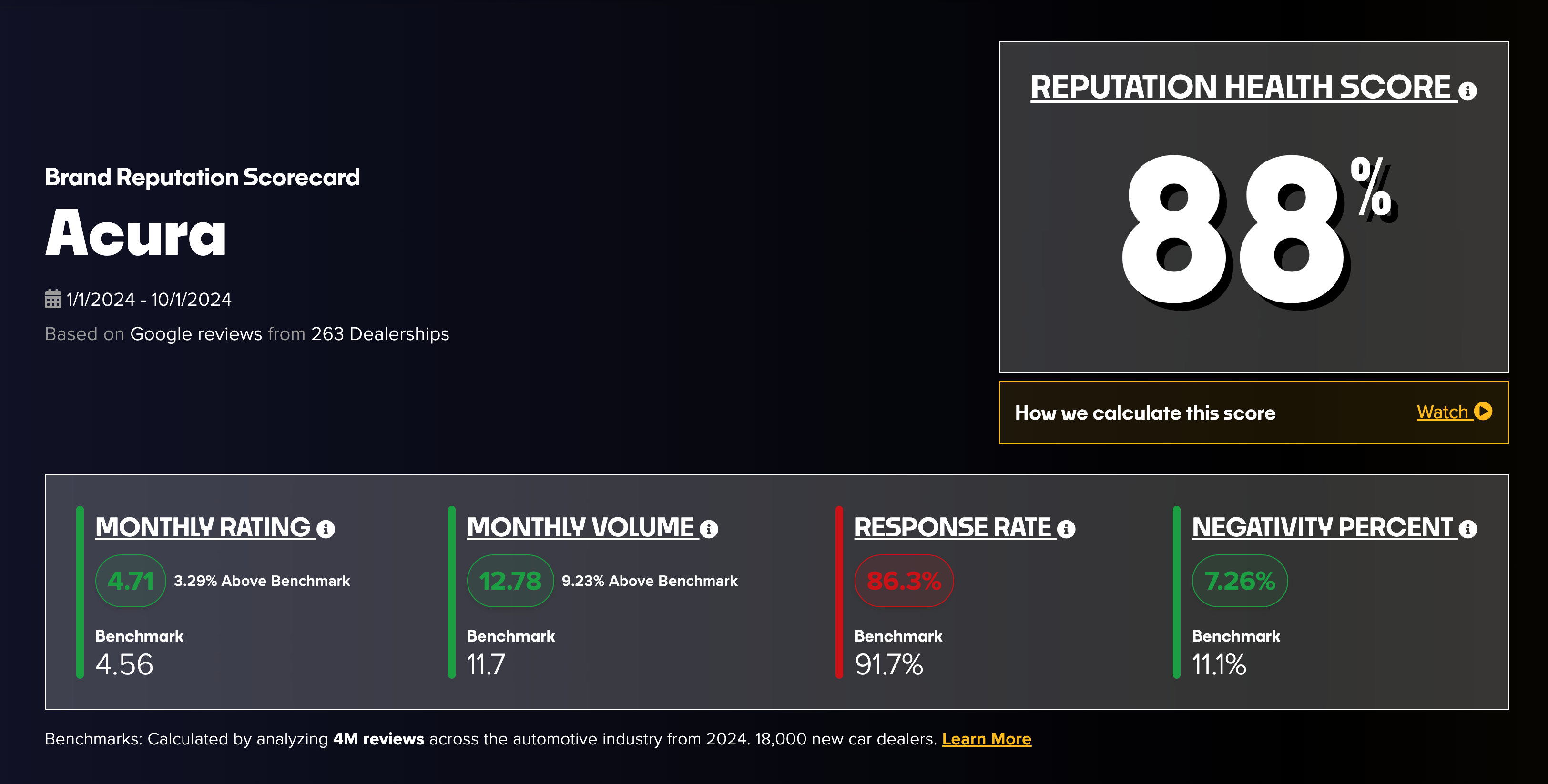

Each scorecard begins with a reputation health score, a top-level look at a business's reputation performance on a scale of 0-100. Paired with the health score is the performance of each business in core reputation metrics, compared to 2024 industry benchmarks.

Further down the scorecard, we cover topic analysis: what is mentioned in the text of the reviews and how often each topic is talked about by customers of the business in question compared to what is typically found industry-wide. The scorecards cover topics GMs care about most first, followed by the 10 most mentioned topics, and finally, all remaining topics we study.

To get a detailed look at the customer experience for each business in maximum detail, head over to the directory and find the OEM or dealer group you’d like to learn about.

What does the scorecard look like?

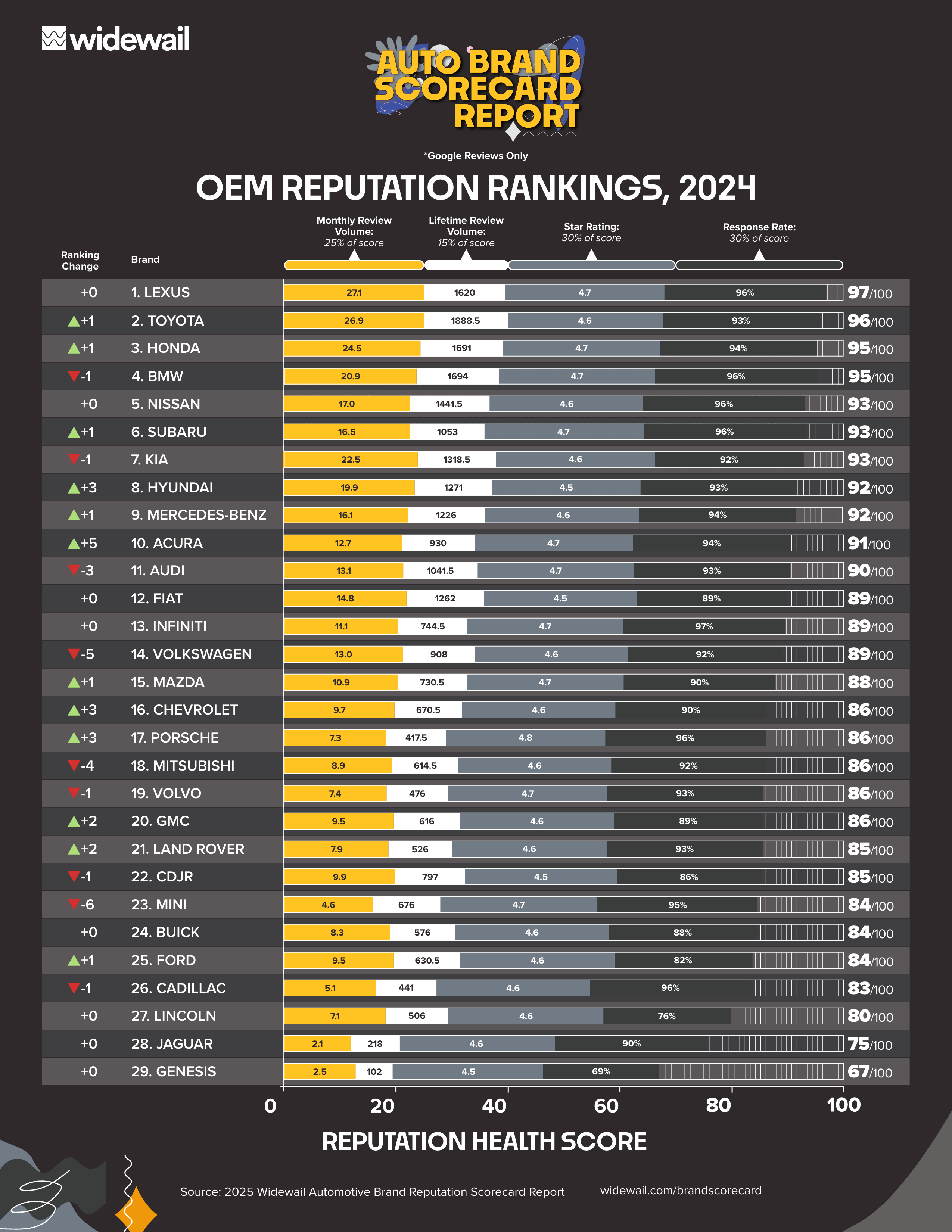

For the second year in a row, Lexus wins Widewail’s automaker reputation rankings, holding off a strong 2024 charge from Toyota and Honda.

To calculate a brand’s health score, we looked at four reputation metrics, weighing each as a percentage based on its impact on overall reputation. Note that the topic performance, i.e., what is discussed within the reviews, is not included in the health score calculation. Widewail’s reputation health score is an assessment of a business’s reputation performance from a tactical perspective. We’ve broken the components of the health score into three categories:

Review Response Rate (30%)

Engaging with customers by responding to reviews is a key component of a healthy reputation. Responses indicate a commitment to service standards and empathy for customers and prospects, while active engagement boosts search engine rankings.

Star Rating (30%)

Rating is a key identifier of business health. Google star rating substantially impacts whether a business appears in local search results and gets considered by potential customers.

Lifetime and Monthly Review Volume (40%)

We believe that review activity is an important indicator of reputation health for a business, and it’s a leading driver of local search rankings. Therefore, we’ve given it a heavy weighting in the calculation of a Widewail reputation health score. This category includes two components: lifetime review volume (15%) and monthly review volume (25%).

Lexus wins. Big gains from Honda and Acura.

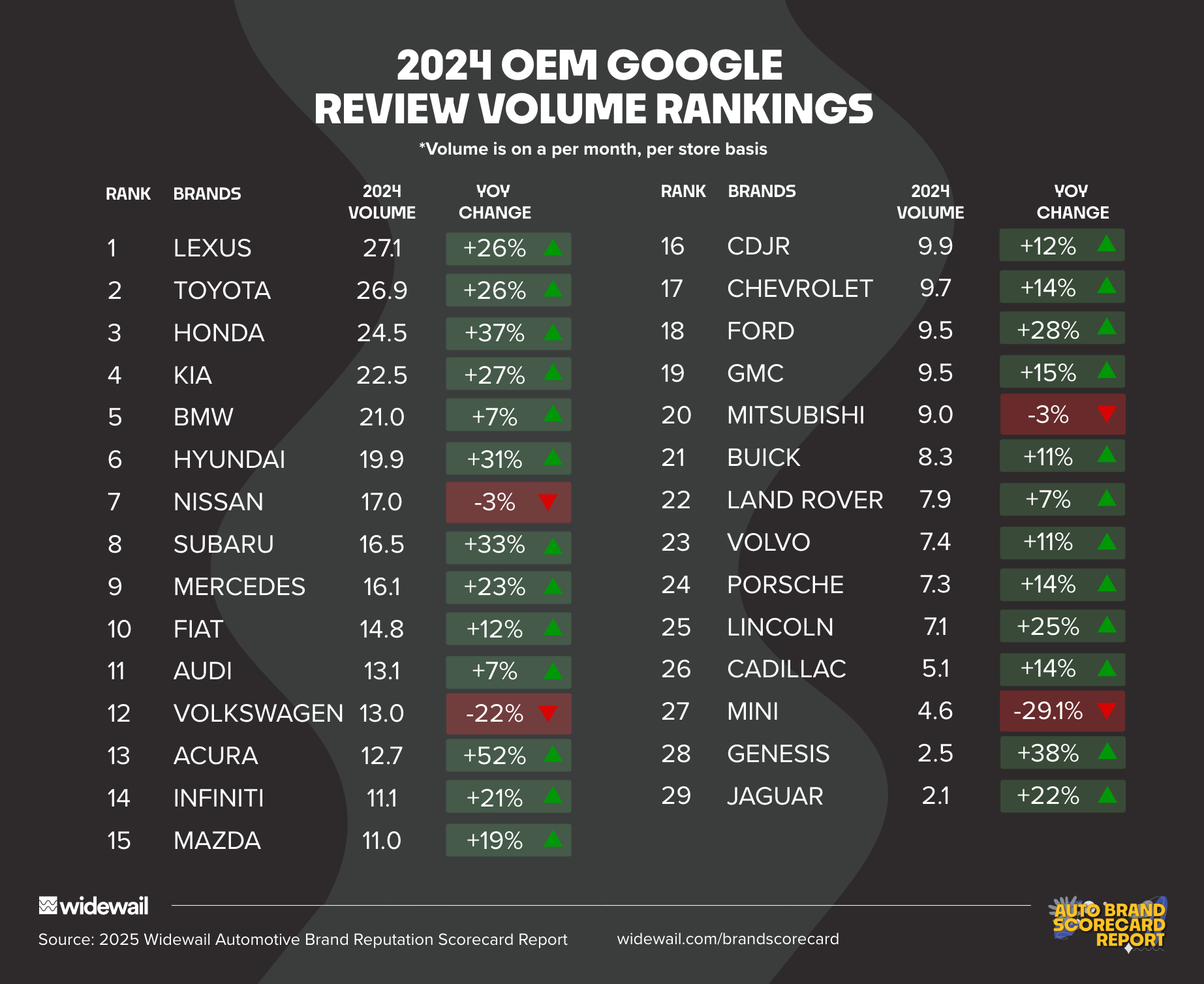

Top 5 brands with most monthly review growth: Honda (+6.7 reviews), Lexus (+5.6), Toyota (+5.5), Kia (+4.8), and Hyundai (+4.7).

Other Highlights:

Only 4 brands saw their median monthly review volume per location drop in 2024: MINI (-29%), Volkswagen (-22%), Mitsubishi (-3%), and Nissan (-3%).

Of these, Volkswagen had the most substantial drop, losing nearly 4 monthly reviews per location, which is largely responsible for Volkswagen dropping 5 spots down the reputation rankings, one of the largest ranking declines. To put this in perspective, a loss of 4 monthly reviews per location for a network of 600+ dealerships results in roughly 31,000 fewer reviews for the brand in 2024.

The formula behind the leading automotive reputation.

Lexus wins Widewail’s OEM reputation rankings for the second year in a row based on its impressive ability to efficiently activate the voice of its customers on a per-rooftop basis. Lexus leads the industry with an average of 27.1 monthly reviews per dealer, growing 26% year-over-year to get there.

Lexus began 2024 as the industry leader in monthly review volume. It maintained the top position, holding off a substantial push from Toyota, which also saw a 26% growth in review volume in 2024, and Honda, which grew 37% YoY. Without its strong performance and growth, Lexus would likely have lost its top spot.

Just as important, Lexus did this while maintaining an average rating of 4.7 stars. When we look into what's driving that 4.7 rating, we learn more about how Lexus dealerships operate and what the industry can learn from their success.

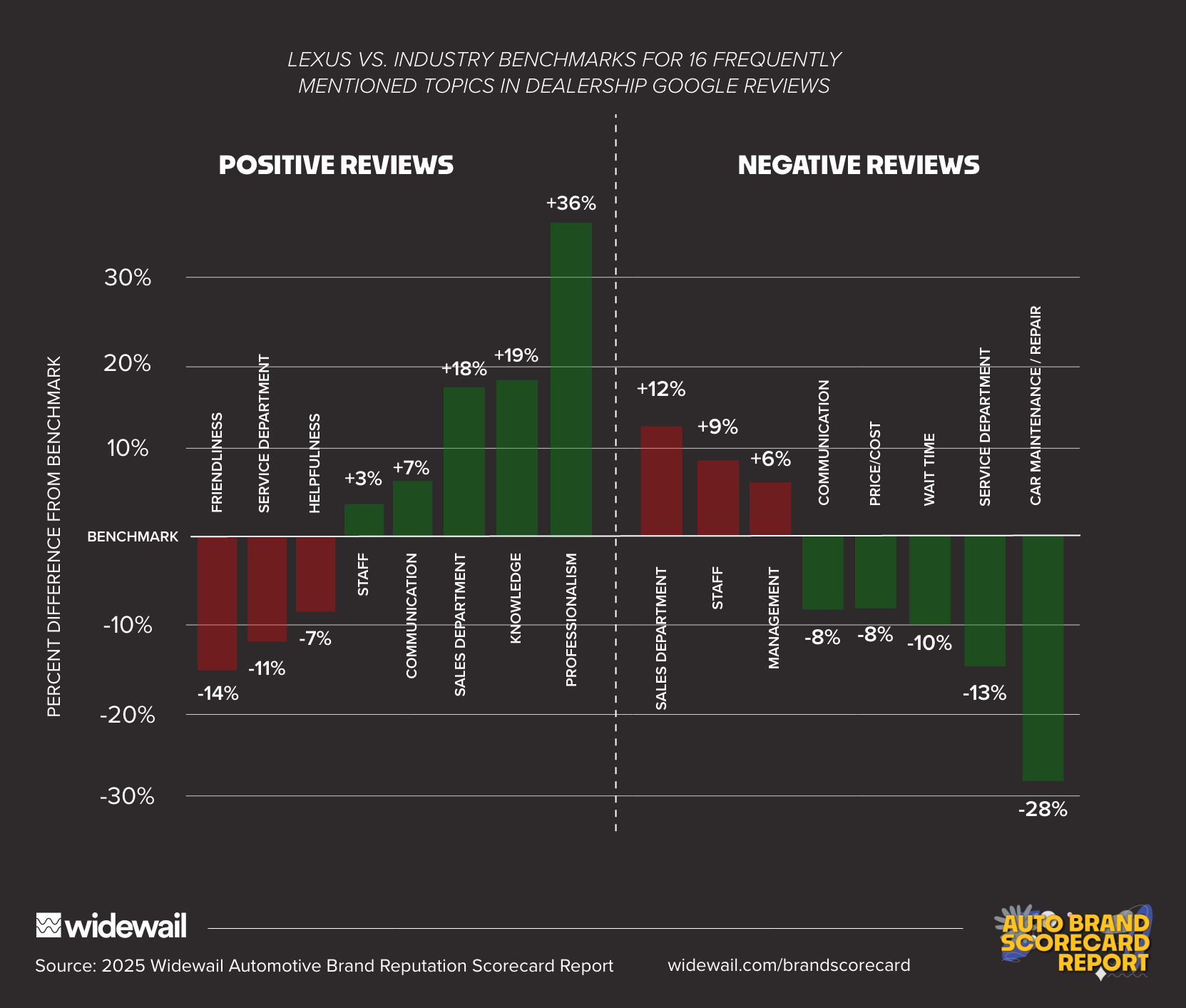

Of the 16 most-mentioned topics industry-wide, Lexus outperforms the industry benchmark in 10 of them. Two topics in particular stand out for Lexus: professionalism and car repair/maintenance.

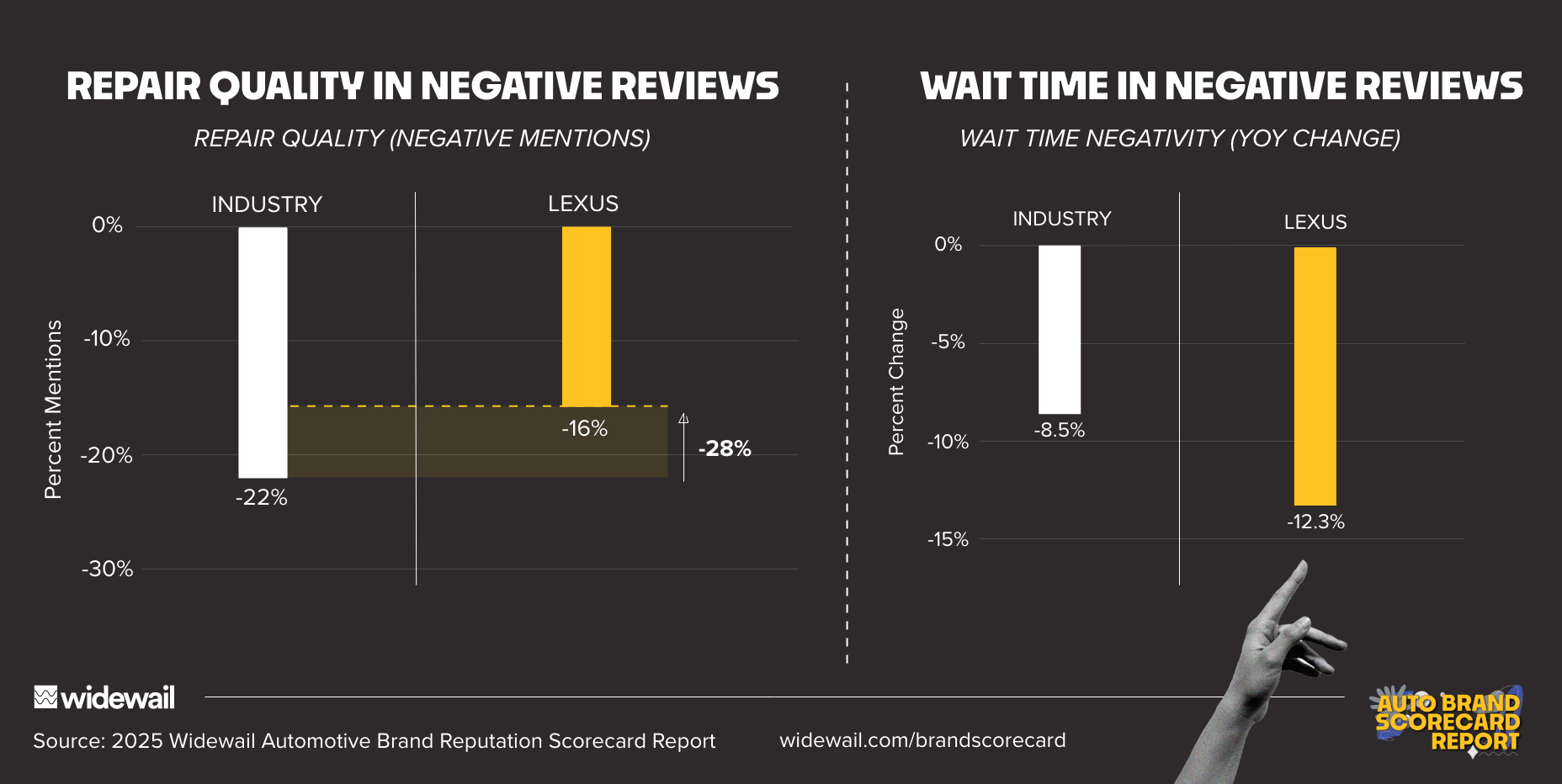

In positive reviews, Lexus customers mention professionalism 36% more often than the industry average. Conversely, in negative reviews, Lexus customers mention car maintenance/repair 28% less often. Lexus ranks #1 among OEMs for the lowest negative mentions of car maintenance/repair.

Although Lexus won, both Toyota and Honda narrowly missed the top spot.

Similar to Lexus, Toyota does a good job of minimizing negative reviews that mention service-oriented topics: service dept., communication, and car maintenance/repair. Wait time stands out as a pain point for the brand, mentioned in negative reviews 18% more often than is typical for the industry. Additionally, Toyota is slightly underperforming the industry in many topics common to positive reviews.

The Honda customer experience story varies from that of Toyota by outperforming the industry in many positive topics. Helpfulness is a strength of the brand, while negativity surrounding price and cost is a problem when stacked against Toyota and Lexus, who receive fewer negative mentions of price/cost.

Generally, Lexus performs strongly in service-oriented categories. Two categories in particular: wait time and repair quality.

Lexus wait time negativity dropped 12.3% YoY, outpacing the average drop of 8.5%. Lexus was already outperforming the industry in 2023, and they’ve increased their lead in 2024. On a related note, of all topics in 2024, negativity related to wait times dropped the most. While Lexus leads the way, this improvement in customer satisfaction is a win for the industry at large.

Lexus is the best (according to customers) at getting repair work done correctly, with car maintenance/repair mentioned 28% below the benchmark in negative reviews, ranking Lexus the best in this category. In 2023, Lexus was ranked #2 in this category.

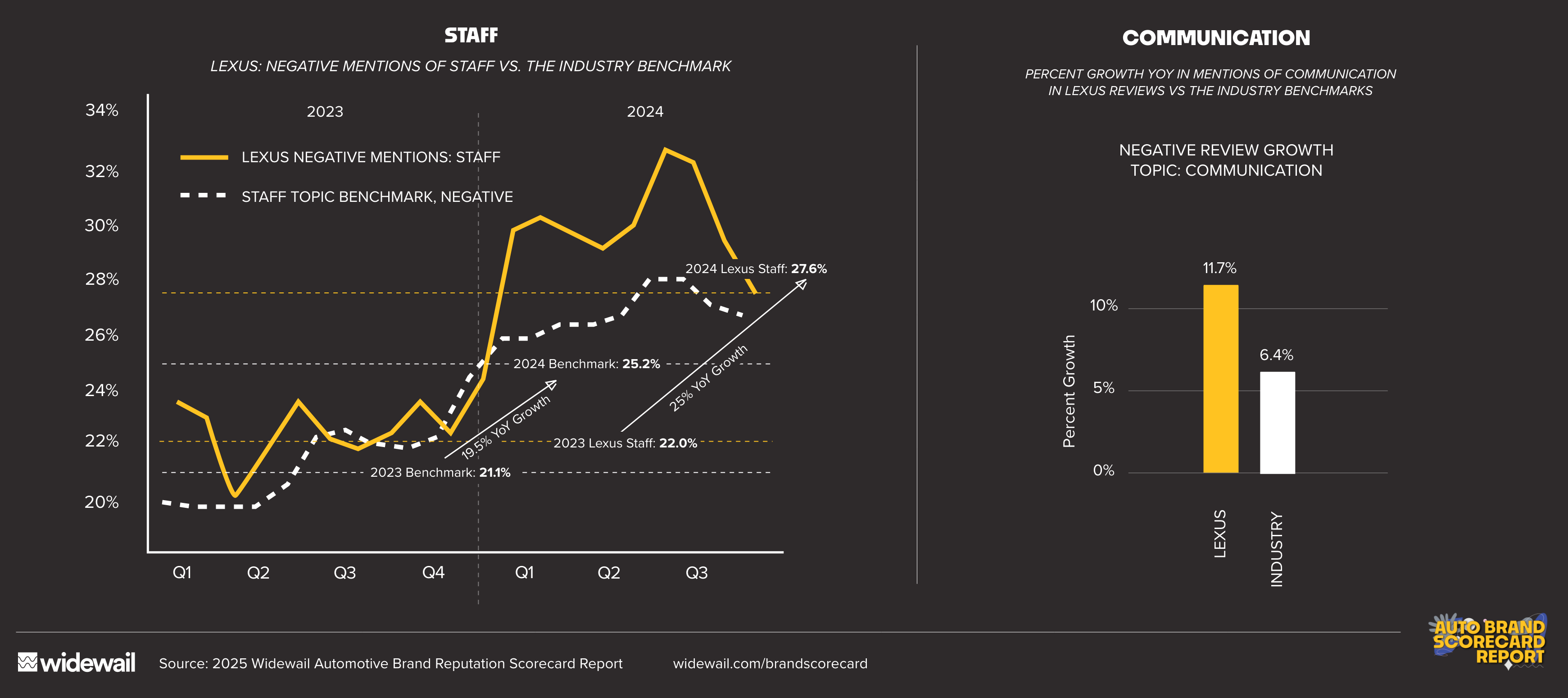

While none of the data suggests major problems for Lexus, we have identified two areas in which brand sentiment is changing less favorably than the rest of the industry when looking at 2024 performance against 2023.

Lexus saw a 9.8% growth in positive staff mentions, lagging behind industry growth of 13.6%. In response, Lexus’s staff positivity ranking among OEMs dropped from #3 to #9. Additionally, negative staff mentions rose 25%, increasing more than the industry growth of 20% during the 2023-2024 timeframe.

While Lexus still outperforms the average by 8%, its negativity related to communication grew 11.7% YoY, dropping from the brand with the second-lowest mentions of communication in negative reviews in 2023 to fourth.

This rankings jump is largely due to a 51% increase in median monthly review volume per rooftop, from 8.4 to 12.7, outpacing the average industry increase of 18%. This growth is primarily in service, where its review volume increased by 53% YoY.

When we explore the details of the Acura customer experience, we find the dealership base distinguishes itself notably in two topics: professionalism and wait time.

In positive reviews, Acura customers highlight professionalism 26% more often than is typical for the industry. This is strong, putting the brand 10th in the rankings for the most positive mentions of professionalism, although it’s in the middle of the pack amongst luxury automakers.

In negative reviews, Acura outperforms the industry with 28% fewer mentions of wait time issues. Acura ranks 5th for the topic. This is even more impressive knowing that industry-wide negative wait time mentions are down significantly in 2024.

Genesis staff negativity only grew 5% this year, leading the industry and fighting against strong headwinds. On average, dealerships saw a 20% growth in negativity around staff this year.

Genesis also had the largest growth of all brands in positive mentions of knowledge, up 12% YoY, outpacing the industry growth of 1%. As we reported in the 2024 Automotive Voice of the Customer Report, knowledge is a key driver of positive experiences in the sales department— the 3rd most important topic. Genesis was 13th in the 2023 OEM rankings for positive knowledge. In 2024, it’s 5th.

Staff is the most common topic in positive reviews in 2024, mentioned in 76% industry-wide. This year, 59% of automakers outperformed the industry benchmark, with more than 76% of their dealership’s positive reviews mentioning a good staff experience. Leading the way is Land Rover, with 83% of its positive reviews highlighting staff, retaining its #1 staff topic ranking from last year.

In 2023, Land Rover had a massive lead of 10 points, but that has evaporated in 2024. Among the top 10 brands, all grew 9-17% this year except Land Rover, which grew less than 1%. Volvo is just outside the top 10, ranked 11th for positive staff mentions in 2024, with a staggering 20% year-over-year growth. Hats off to Volvo.

Only five brands saw any growth in positive mentions of their Sales Departments in 2024. Volkswagen had the largest growth at 10%.

The top five:

For positive mentions of staff, Volkswagen grew 19.8% YoY, the largest of any brand, outpacing the industry growth of 14%.

Both Toyota and Honda have seen a 9% reduction in negativity around pricing YoY, the two largest improvements of any OEM. For two powerhouse brands among non-luxury buyers, this is a good sign for pricing sentiment. With that said, they still don’t rank well for the topic (22nd and 27th places, respectively), with relatively high mentions of pricing in negative reviews. Kia saw a 7% drop in mentions of price and, consequentially, a substantial move up the topic ranks in 2024 from 12th to 4th.

More good news: Honda’s positive mentions of deals grew 11.69% YoY, outpacing the industry growth of 6.3% (86% over the benchmark). In 2023, Honda ranked #11 for positive mentions of deals. In 2024, it ranks #7.

Jaguar has had a year of ups and downs, but undoubtedly, the brand’s growth in service department positivity is a win. Specifically, Jaguar saw the greatest increase of any brand in positivity for its service department, growing 16.5%. Most brands saw positivity surrounding service departments grow in 2024 with only four brands recording a decline: Genesis, Land Rover, MINI, and VW.

MINI fell six spots in the reputation rankings, the most of any brand this year. While MINI’s loss of rankings is primarily related to a 29% drop in monthly review volume per dealership, the brand is also experiencing challenges with negativity related to staff, communication, and knowledge.

Negative mentions of staff are up 55% YoY, the largest gain of any brand, far outpacing the industry average of 20% growth. Related to communication, negative mentions grew 12.7% YoY for MINI, the highest of any brand, outpacing the industry YoY growth of negativity at 6.4%. Only Volkswagen saw more growth than MINI this year in negative mentions of knowledge, both up over 20%.

Volkswagen struggled with review efficiency in 2024, losing 22% of its monthly volume per location (from 16.6 reviews to 13), resulting in a ranking drop from #9 to #14. The brand saw huge growth in mentions of its sales department this year, resulting in the highest YoY growth rate of department mentions for any brand in BOTH positive and negative reviews. While positive mentions of the sales department grew an impressive 10%, negative mentions grew sharply, at 34%.

Communication is the #1 cause of negative reviews, and, as a result, we watch that metric closely. We were surprised to see Mercedes-Benz finish as the lowest-ranked brand for communication, with over 45% of its negative reviews mentioning communication. This is the result of a year with 10% growth in mentions of the topic for the brand, the 7th-highest growth rate among OEMs. Mercedes falls nine spots in the 2024 negative communication topic rankings, from #23 last year to #32 today.

Jaguar saw a 25% increase in negativity related to pricing from 2023 to 2024. No other brand came close to that. During that same period, negativity around pricing has dropped 1.7% industry-wide. Porsche was #2 with 14% growth in price negativity, Hyundai #3 with 11% growth, and Genesis rounded out the top four with 10%.