-

Products

TechnologyManaged Services

- Resources

- Pricing

- Company

If you work at a bank or credit union, you already know that the work you do tends not to draw the same volume of online reviews as, say, restaurants or car dealerships. Here are six ideas to get started generating more reviews.

If you work at a credit union, you already know that the work you do tends not to draw the same volume of online reviews as, say, restaurants or car dealerships. It can be hard to know how to generate more reviews when your high-stakes yet paperwork-heavy industry resists the kind of bells and whistles that other businesses use to get customers raving. But wonder no more - here are some proven ways to get your review volume up:

You’ll be impressed with the results

More often than not, being straightforward pays off: a 2019 Brightlocal study found that 76% of customers who are directly asked to write a review do so. Train your staff to bring it up at the end of every transaction, or use an SMS-based review generation solution like Invite - however you ask, the reviews will start coming in.

Fewer people, but your people

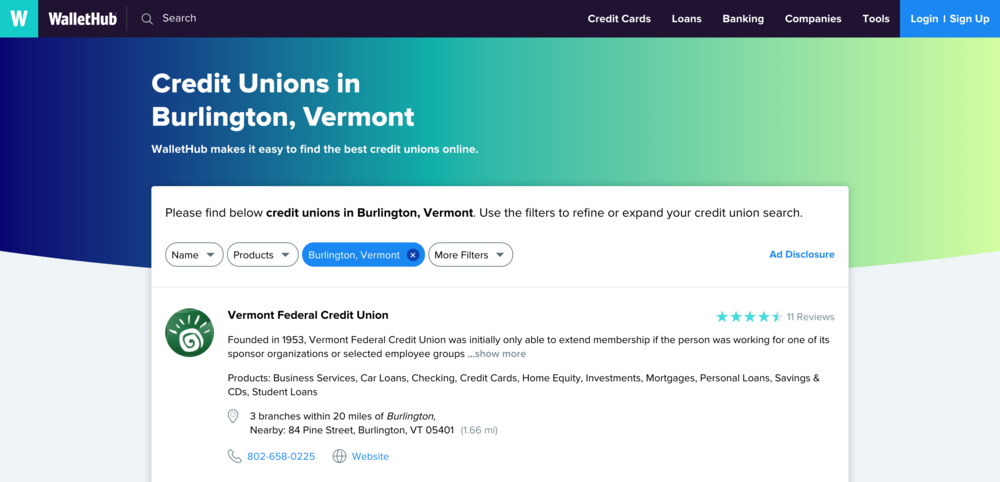

Yes, everyone checks Google and Yelp, so don’t neglect them. But savvy customers will know to also check sites like DepositAccounts and WalletHub for more in-depth reviews about the banks in their area. Make sure your business’s presence on these sites is just as up-to-date as your Yelp or Google My Business pages.

Just a little extra encouragement

If you hand every customer a receipt or a business card at the end of the transaction, make sure it has a review request on the bottom. A physical object is hard to ignore.

Set it once and let it go to work

An even easier way to plant the idea of leaving a review in a customer’s mind is to put a request in your email signature. That way, any customer that reaches out with a question will see the request in your response - and hopefully it’s the kind of helpful response that inspires a rave review! Drop a hyperlink to your preferred review site in your signature and watch the feedback roll in.

Train your front-line workers to ask these

One effective way to get customers talking about what you want them to talk about is to frame your request as a question. For many banks and credit unions, you might ask your customers “Would you recommend us to a family member?” or “Did our customer service associate address all of your concerns today?”

Like putting a fresh log on a smoldering fire

Whether you use reputation management service like Widewail Engage or train your in-house marketing team to do it, research shows that 71% of customers are more likely to choose businesses that respond to all of their online reviews. When you respond, make sure to acknowledge the customers that mention a positive experience with your team - it’ll make future customers more inclined to do the same.

Thanks for reading. Next, we recommend our new playbook, 2021 Local Business Reputation Management Playbook. 34 pages of Widewail's best insights for in one place. If you are looking for an operational guide to lay out a dynamite strategy, this one is for you. Download the playbook 👇

I joined Widewail last year as a Review Response Specialist, blog contributor, and the team’s resident native New Yorker, meaning I spend my days responding, writing, and derailing staff meetings with my strong opinions about pizza. I cut my teeth in the publishing industry, so client relations and content creation are second nature to me, and I received my BA in History from Smith College. In my off hours you can find me reading, baking from my worryingly large collection of cookbooks, and building my snow-shoveling muscles in this thing you guys call a “driveway.”

Bite-sized, to-the-point, trend-driven local marketing stories and tactics.

Automated Review Generation

Video Testimonial Generation

Maintain Accurate Listings

Private Surveys

Review Response Managed Services

Social Media Engagement Services

©Widewail 2025.

U3GM Blog Post Comments